The United States runs a trillion-dollar annual trade deficit because it has lost most of its manufacturing industries. Although we created all the industries of the digital age, they mostly have migrated overseas.

The result is not only a chronic trade deficit but lower growth potential. Our top exports are agricultural products. That’s a reversion to our export profile of the 19th century, before we became a manufacturing power.

We have had growth in software companies such as Google, Facebook and Amazon. While these companies generate international revenues, they don’t replace the earnings of the lost export industries.

This chronic condition hasn’t led to an economic crisis—yet—because we enjoy unlimited access to cheap dollar credit. The world is willing to exchange its goods and services for dollar credit that it holds as portfolio investments and as an international medium of exchange. The dollar remains the world’s leading reserve currency.

But such a privilege will inevitably come to an end, as it did for the United Kingdom before us. The underlying imbalance must be corrected, and that cannot be done quickly or easily. It took many years to get into this hole and it will take years to climb out.

A solution requires a fundamental change in attitude towards industrial policy.

Industrial policy—government action to promote American manufacturing and protect it from international competition—is unpopular in the U.S., at least during peacetime. But some major industries are already subject to government planning, such as the protection of automotive manufacturers by international trade agreements.

In many other cases, though, the absence of industrial policy is simply an illusion. It isn’t that the U.S. doesn’t have an industrial policy, but rather that America is governed by China’s industrial policy.

Donald Trump tried to reduce the trade deficit by imposing tariffs. But tariffs don’t do much after domestic production has already shut down, when skills and supply chains have atrophied.

Tariffs might encourage domestic production by persuading foreign brands such as Samsung to build domestic plants. Indeed, foreign automobile companies built assembly plants in the U.S. after Washington imposed import limits. Other measures, such as import barriers, aren’t the best solution because they protect inefficient firms. The best approach would be to incubate innovative new industries, ones that have economic viability and won’t depend on subsidies indefinitely, and keep them in the U.S.

Private innovation and risk-taking, not government diktat, built the great American companies of the digital age. Government played a role by funding basic research through national laboratories and their corporate counterparts like Bell Labs and RCA labs. But corporate funds and private capital markets moved these innovations from the laboratory to the commercial market.

But that was decades ago. The world economic environment has changed. There is much more global competition eager to exploit U.S. innovations. Promising new markets have international competitors waiting in the wings. Given the emergence of China as a growing player in technology industries, private capital often has to compete with state funding when launching new industries, even ones of importance to the country’s long-term welfare. This puts a severe handicap on Americans trying to build domestic high-tech industries that may take many years to become profitable, such as telecommunications infrastructure and renewable energy. Such a problem can easily deter private capital.

In some cases the United States has no good choice except to deploy subsidies to offset Chinese subsidies. Whether these should take the form of tax credits for capital investment, research and development or direct subsidies depends on the industry.

STR/AFP/Getty

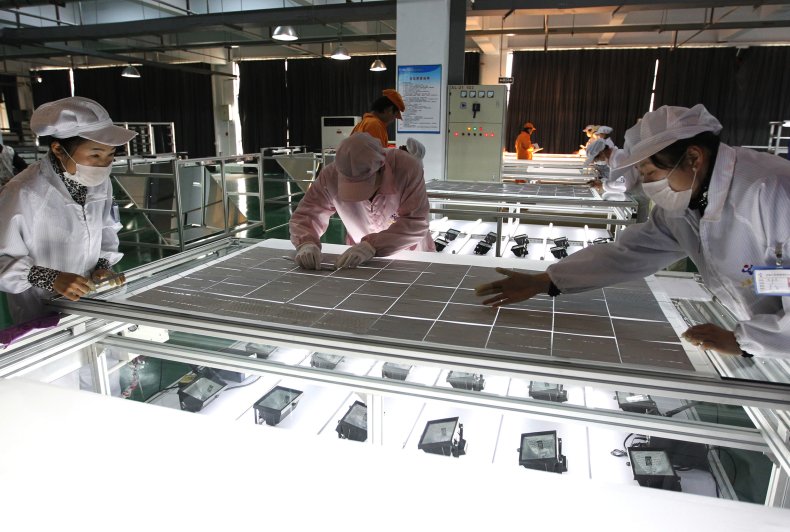

The $30 billion solar panel industry is a case in point. The solar cell that converts sunlight into electricity was invented in the U.S. in the 1960s. These devices were initially costly, but cost reductions over time made them a practical source of renewable energy.

The U.S. and other countries offered subsidies to consumers for solar converters starting in the early 2000s, creating a huge market. Limited government funding and venture capital enabled mass production of low-cost panels in the U.S. and Germany, with technology developed at the Georgia Institute of Technology and the Fraunhofer Institute. The result was a solar panel manufacturing industry backed by private and public market capital.

But Chinese planners made solar panels a strategic priority, and provided cheap financing through the state banking system. Chinese competitors imported U.S. and German equipment and built massive plants with a supply chain that integrated the whole production cycle. The Chinese cut the price of solar panels by two-thirds in a period of five years and launched big export programs.

Although the U.S. subsidized consumers who installed solar panels, it didn’t subsidize the producers. We imposed tariffs, but the Chinese kept import prices low by absorbing the difference. U.S. and German manufacturers couldn’t compete and ceased operations, and a German and American innovation turned into a Chinese industry.

How could this have been avoided? We could have required that panels installed with consumer subsidies come from U.S. factories. Panel costs would have been higher but the impact on installed panel electrical systems would have been small, because panels comprise only a small part of the typical installed system cost. But in exchange for those higher costs, the U.S. would have remained an innovator and production leader in solar energy conversion.

The same applies to wind power. Little of the equipment for wind power is made in the U.S., so support for renewable energy will mean substituting imported machines for domestically produced hydrocarbons, increasing the trade deficit.

Government subsidies carry risks. Cronyism could turn them into handouts for politically connected industries, and government funding can prolong the life of inefficient firms. Subsidies should be the exception, not the rule. And exceptions should be made for industries of strategic importance. Two stand out: semiconductors and telecommunications.

Semiconductor chips constitute the electronic “brains” of practically all industrial products. They also power the artificial intelligence software that will increasingly enhance industrial, consumer and military technologies. The U.S. invented the computer chip and created what is now a $400 billion global industry, but its domestic production is now less than 10 percent of the world’s total. Technological leadership shifted overseas, mainly to Taiwan and South Korea, in large part because foreign governments subsidize what is now the world’s most capital-intensive industry. A state-of-the-art chip foundry now costs around $20 billion to build.

Facing subsidized competition, U.S. companies chose to focus on chip design and marketing. At the current trajectory, there will be little domestic chip production in a few years. With the disappearance of the hardware industry, the U.S. eventually will lag in software as well.

In telecommunications equipment, the U.S. does not manufacture any of the strategic products that form the backbone of today’s economy.

That leaves us almost totally dependent on foreign sources for the critical technologies driving not only economic growth but also military capabilities. Without domestic chip manufacturing it’s impossible to safeguard the core intelligence of defense systems and critical infrastructure. And with telecommunications dependent on foreign equipment, the security of national communications systems may well be at risk.

There’s no one-size-fits-all solution. We are dealing with two separate problems. In the case of semiconductors we need to reverse the trend toward offshore manufacturing. That can be remedied with government-guaranteed financing for new facilities. The government also should increase its support for manufacturing-oriented research at university and government laboratories. Close coordination with industry is required to ensure the effective movement of research results into commercial implementation.

The telecommunications equipment problem is tougher, because there are no domestic companies left. The U.S. will need to bring foreign companies from friendly nations here. For example, we might consider a government-backed deal for Sweden’s Ericsson and Finland’s Nokia to establish large U.S. facilities. China is already doing this; Nokia’s largest R&D facility is in Shanghai, with a staff of 16,000. The revenues of these companies would be boosted by restrictions on imported equipment for strategic infrastructure. Government-funded research in collaboration with U.S. laboratories would be further inducement to encourage companies to move telecommunications manufacturing to the U.S. The stakes for America’s economy and security are simply too high to maintain the status quo.

Dr. Henry Kressel is a technologist, inventor and private equity investor. His most recent book (with Norman Winarsky) is If You Really Want to Change The World: A guide to creating and sustaining breakthrough ventures (Harvard Business Review Press, 2015). David P. Goldman is Deputy Editor of Asia Times and author of You Will Be Assimilated: China’s Plan to Sino-Form the World (Bombardier Books).

The views expressed in this article are the writers’ own.