The British isles economic system let down anticipations and shrank in August as the charge of living disaster hit domestic budgets and organization exercise.

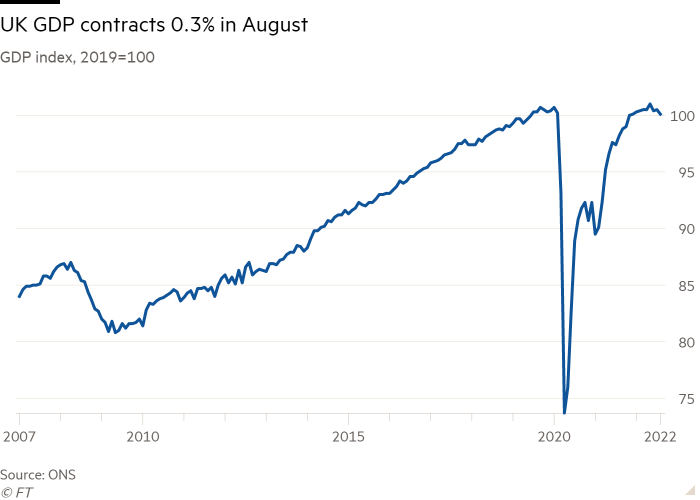

Gross domestic product fell .3 for every cent involving July and August, in accordance to details printed on Wednesday by the Office for Nationwide Data.

Economists polled by Reuters had predicted no month-on-month change.

In the three months to August, output was down .3 for each cent when compared with the earlier three months, also decreased than analysts’ anticipations.

Industrial generation contracted 1.8 for every cent amongst July and August and companies registered a .1 for each cent drop.

Grant Fitzner, ONS main economist, claimed section of the contraction in industrial output was due to the slide in oil and gasoline manufacturing triggered by North Sea summer upkeep.

He extra that wellbeing also contributed to the GDP decline, with a fall in the amount of healthcare facility consultations and operations.

Athletics situations also had a slower month immediately after a solid July, even though lots of other buyer-struggling with products and services struggled, with retail, hairdressers and lodges all faring rather poorly.

Commenting on the GDP knowledge, chancellor Kwasi Kwarteng highlighted soaring electrical power selling prices induced by Russia’s invasion of Ukraine, and expressed self-assurance that the government’s system would “grow our economy”.

On Tuesday, the Intercontinental Financial Fund downgraded the United kingdom economic outlook, forecasting a .3 for each cent expansion up coming calendar year, down from 3.6 per cent this 12 months.

Brian Coulton, chief economist at the score agency Fitch, expects a more extreme downturn, with the economic system shrinking by 1 per cent in 2023, reflecting sector turmoil and the prospect of higher interest fees adhering to the government’s large unfunded tax cuts announced past month.

Robert Alster, main financial investment officer at the investment management corporation Close Brothers Asset Management, mentioned that “a great deal will depend on what the chancellor claims in the Spending budget following month”, when the Treasury will request to bolster self-assurance in the UK’s financial debt sustainability.

“Unless they be successful, economic ailments will remain restricted, and are most likely to weigh on development,” he included.