deberarr/iStock Editorial via Getty Images

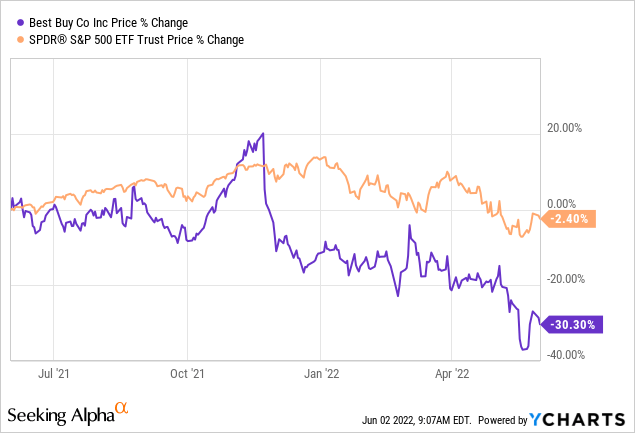

In the last 12 months Best Buy’s (NYSE:BBY) stock price has fallen more than 30% compared with the mere 2% decline of the broader market.

In our opinion, this sell off is not entirely justified as the fundamentals of the stock remain strong, despite the softer guidance than previously expected for 2022. We believe that the current price levels could be an attractive entry point for investors with a longer investment horizon, however we have to highlight some of the key risks and macroeconomic headwinds that may negatively influence BBY’s financial performance in the near term.

Pros

1.) Strong track record of growth

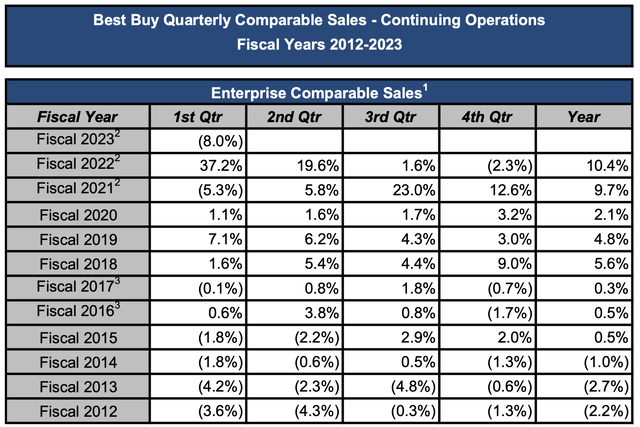

Since 2015, Best Buy has been successful in increasing its revenue every single year, with an exceptionally strong performance in the previous two years.

Enterprise comparable sales growth (Best Buy)

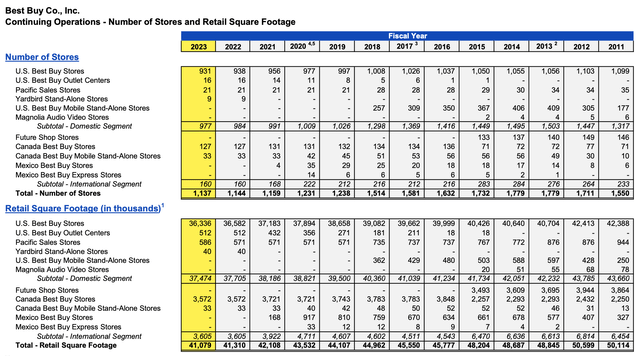

Important to point out that this sales growth was organic and not driven by opening new stores or increasing the square footage. In fact, quite the opposite. The following table shows that the number of stores have declined by almost 600, reaching 1137 this year, compared to the peak of 1779 in 2014. Not only the number of stores, but also the square footage has decreased significantly.

Number of stores (Best Buy)

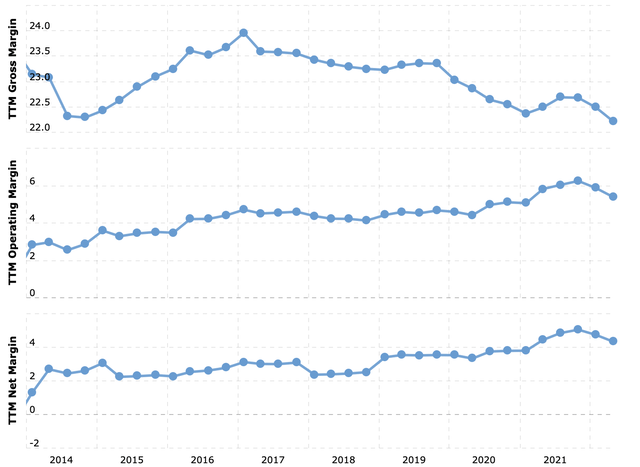

In the same time period, partially due to the store closures the operating- and net margins of the business have been consistently improving.

Margins (Macrotrends.net)

Although past performance is not a guarantee for future success, in our opinion, Best Buy has a strong track record of successfully executing its growth strategy, which could make the stock an attractive candidate for long term investors.

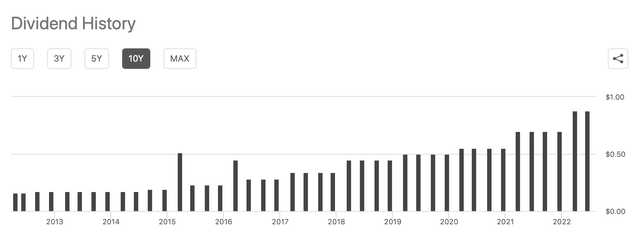

2.) Dividends

Best Buy has also shown strong commitment in the last 18 years to return value to its shareholder in the form of dividend payments.

Dividend history (Seekingalpha.com)

The currently declared quarterly dividend is $0.88 per common share.

When looking at dividend payments, we also have to make sure that the dividends are safe and sustainable. A good indicator of the sustainability is the dividend payout ratio. Best Buy’s dividend payout ratio is approximately 33%, which is slightly higher than the consumer discretionary sector median of ~26%, but about in-line with the firm’s own 5 year average.

We believe that Best Buy’s stock could be an attractive choice for dividend investors looking for sustainable and growing dividend payments.

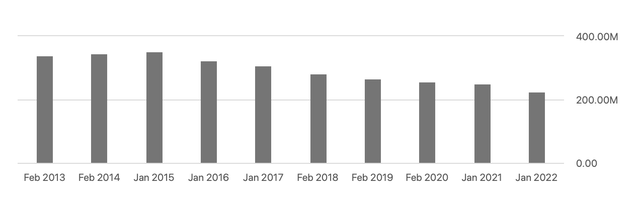

3.) Share buybacks

The firm has been returning value to its shareholders not only through capital appreciation or dividend payments, but also through share repurchase programs. The firm has announced in their quarterly press release that they maintain their guidance for the year to purchase back share for about $1.5 billion.

In the last ten years, Best Buy has reduced the number of its common shares outstanding by approximately 30%.

Shares outstanding (Seekingalpha.com)

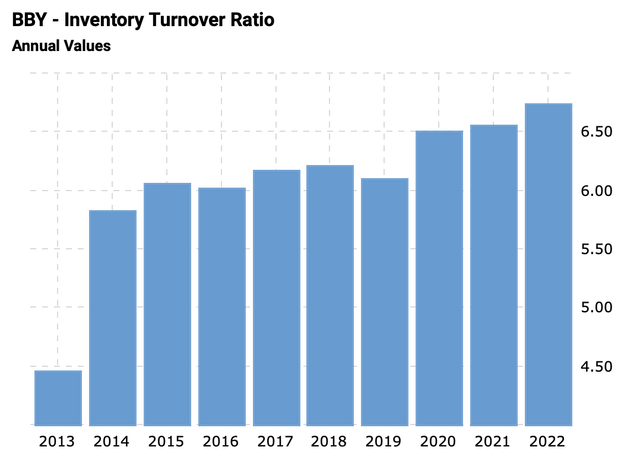

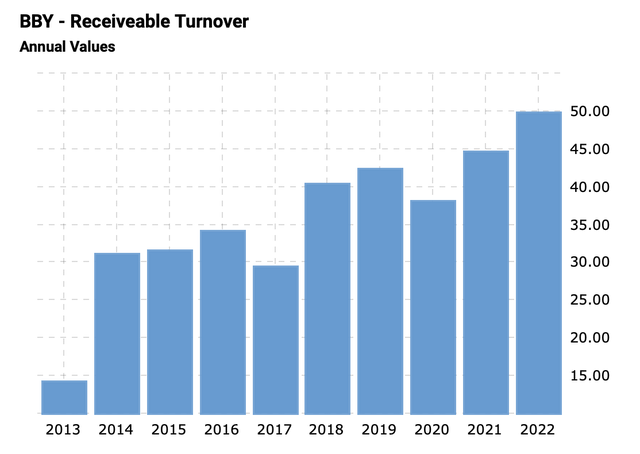

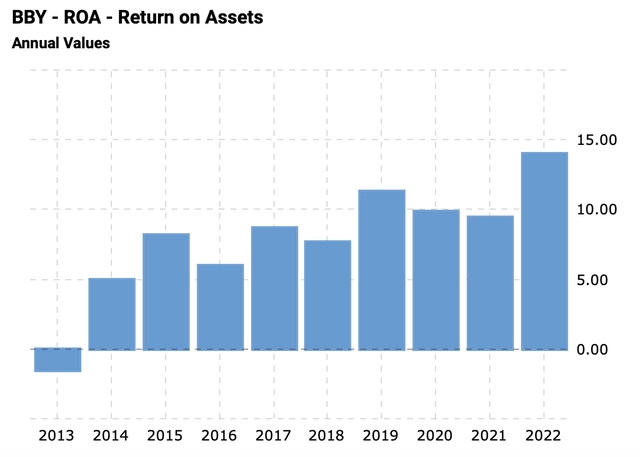

4.) Improving efficiency

When looking at Best Buy’s balance sheet and at some of the key financial ratios, we can observe that the firm’s efficiency has been consistently improving over the years. This improvement is reflected by the improving inventory turnover ratio, by the improving receivables turnover and last, but not least, by the increasing retur

n on assets.

Inventory turnover ratio (Macrotrends.net) Receivable turnover (Macrotrends.net) ROA (Macrotrends.net)

As mentioned earlier, past performance is not a guarantee for future success, however we believe that the firm’s improving inventory and receivables management provides a solid foundation for strong future financial performance.

Valuation

After the significant decline in the stock price, Best Buy’s valuation became significantly more attractive, according to the traditional price multiples.

The price-to-earnings ratio of the firm is currently 9.3x, about 25% lower than the sector median, the firm’s EV/EBITDA is about 28% below the sector median and last, but not least, in terms of price-to-cashflow BBY is trading at a 30% discount compared to its peers.

BBY’s valuation does not only compare favourably to the sector medians, but the multiples are also significantly below the firm’s own 5 year averages.

Although analysts do not estimate a significant growth in EPS in the near futures, in our view, such a discount could potentially provide a good opportunity for long term investors, however we believe, in the short term there may be temporary headwinds resulting in further downside risk. Further, we believe that the recent acquisitions of BBY could fuel growth in the years to come.

Cons

To make a well-informed investment decision, we also have to take a look at some risk factors that may monetarily impact Best Buy’s financial performance in the near- or long term.

1.) First quarter financial results and weaker than expected guidance

One of the most obvious reasons for not starting a position right now is the relatively poor performance in the first quarter and the worse than expected guidance.

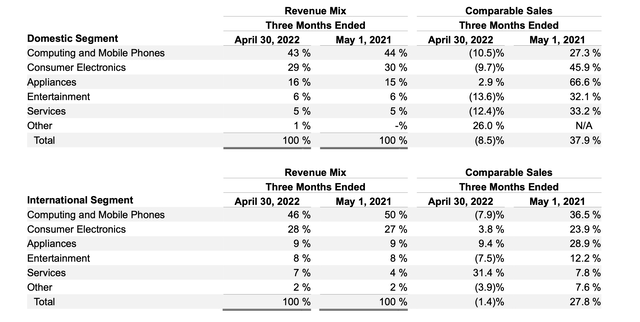

In Q1, Best Buy’s sales have declined across all their segments compared to the year ago quarter. Enterprise comparable sales have declined by as much as 8%. Domestic comparable sales have declined by 8.5%, international comparable sales declined by 1.4%, while domestic online sales declined by 14.9%.

Revenue mix (Best Buy)

The decline in domestic sales have been observed across all product categories, however the primary contributors we computing and home theatre. Not only the revenues have declined, but also the margins have contracted slightly, driven by three primary factors: lower services margin rates, lower product margin rates, including increased promotions and higher supply chain costs.

International sales have mainly declined due to exiting Mexico and a comparable sales decline of 1.4% in Canada. Although revenue declined, the gross margin has slightly expanded due to the larger percentage of revenue from the higher margin services category in Canada.

In their guidance, BBY also reduced its guidance for the rest of 2022, resulting in expected revenues in the range of $48.3 billion to $49.9 billion and expected comparable sales decline in the range of 3.0% to 6.0%.

Although declining sales and contracting margins are not desirable, we believe many of the macroeconomic headwinds that are responsible for these financial results may be temporary. Let us take a closer look at these macroeconomic factors.

2.) Macroeconomic headwinds

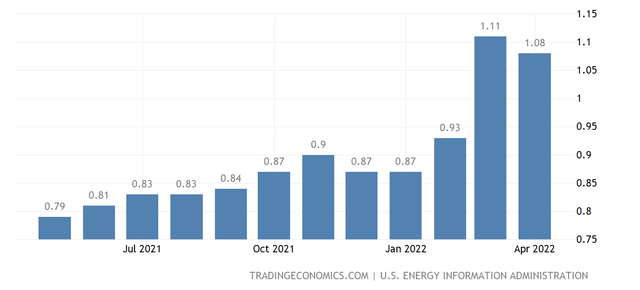

Elevated gasoline prices

Elevated gasoline prices, since the beginning of the geopolitical tension in the Eastern European region, have been causing headwinds for most businesses, by resulting in a significantly higher cost of transportation than previously expected.

Gasoline prices (Tradingeconomics.com)

Although prices seem to have peaked in March, we believe the prices are to remain elevated for the rest of 2022.

A further positive development is that the OPEC+ group has recently agreed to increase oil output in July and August, which we expect to lead to lower oil prices.

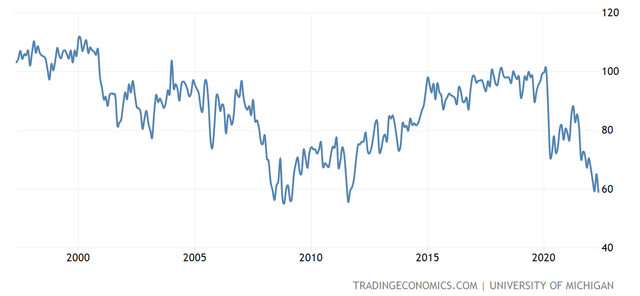

Declining consumer confidence

Although consumer spending has remained strong in the first quarter, consumer confidence has been consistently declining in the past few months, reaching a 10-year low and approaching levels seen in 2008-2009.

U.S. Consumer confidence (Tradingeconomics.com)

In our opinion, the low consumer confidence will eventually likely to result in lower consumer spending. In times of low consumer spending, firms in the consumer discretionary sector are especially hurt, as customers are likely to cut on or delay the purchase of non-essential, durable items. Therefore, we believe that Best Buy’s business is not well-positioned in the near term.

Inflation

In our opinion inflation also poses a significant risk to Best Buy’s business in the near term. Due to the high competition, we are not convinced that BBY will be able to pass over the elevated input costs to their customers, res

ulting in contracting margins, as already observed in the first quarter. Although many customers like shopping in Best Buy due to the in-store experience, we believe that the competition from online retailers, including Amazon (AMZN), remain high. Further, many firms are shifting to direct to consumer sales approach to improve their margins. This tendency could also negatively impact BBY.

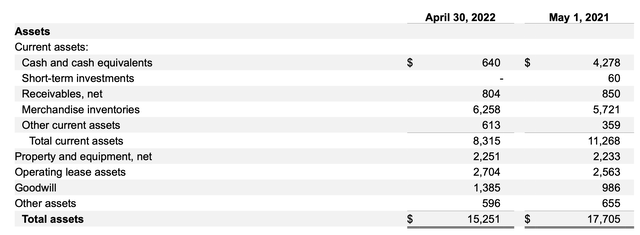

3.) Decline in cash and cash equivalent and current assets

Best Buy’s cash and cash equivalents at the end of the first quarter were $640 million, compared to $4.3 billion in the year ago quarter.

Assets (Best Buy)

The acquisition of Current Health and Yardbird in 2021, were contributors to this decline.

As a result, BBY’s current ratio and quick ratio declined significantly to 0.96 and 0.17, respectively. Such low liquidity ratios indicate that the financial flexibility of the firm is limited and in our opinion, the firm may have difficulties with tackling the potential headwinds in the near term.

Key Takeaways

Declining sales and contracting margins in the first quarter are a result of several macroeconomic headwinds.

The headwinds are expected to last at least in 2022, however positive developments in terms of oil price are expected in the second half of the year.

Best Buy has a strong track record of buying back shares and paying dividends to its shareholders.

The firm appears to be undervalued based on the traditional price multiples, compared to the respective sector medians and also to its own 5 year averages.

Due to the macroeconomic headwinds we rate BBY’s stock as a hold.