pawel.gaul/E+ via Getty Images

Investment opportunities considering monetary policy

Monetary policy is the basis for our investment decisions. Through it we can outline the prospects of an asset class, and thus understand where to invest for higher returns. During expansionary monetary policy phases, interest rates are very low, which encourages borrowing and growth rates. Risk-free rates are low, and as a result the stock market is the asset class that benefits most from this situation. At the same time, however, the opposite is also true. During tight monetary policy phases, risk-free rates rise, and it is the stock market that suffers the most.

Because of the pandemic in 2020, most of the world’s major economies carried out expansive monetary policies as never before to support the economic shock brought about by Covid-19 and ensure that the economy had enough money to restart. 2 years later, these ultra-expansive policies have caused the economy to recover quickly, but have entailed a much greater risk, namely high inflation.

The reasons for such high global inflation cannot be attributed only to the huge injection of liquidity into the system, but also to exogenous factors such as supply chain issues and the war in Ukraine. High inflation is a serious problem for a country’s economic stability, and central banks around the world will do their utmost to bring it back within the target range between 0% and 2%. However, it should be specified that not all major economies in the world are suffering from high inflation, and this will be the focus of this article. China, Japan, and Switzerland currently do not have serious inflation problems, so interest rates are not expected to be raised as quickly as in the U.S.

Any economic crisis in the U.S. would still affect countries around the world because of globalization, but I believe there are some countries that are better prepared than others to deal with a global crisis, in particular Switzerland. In this article, a U.S.-Swiss comparison will be highlighted, and I will explain why I believe Switzerland will perform better within the current macroeconomic scenario.

U.S.-Swiss comparison

The comparison between these two economies will be made by looking at the growth of the M1 monetary aggregate, their monetary/fiscal policy, their inflation rate, and their respective yield curves. Before proceeding with the comparison, it is important to note that the comparison should always be put into context based on the importance of the two countries: the GDP of the U.S. is 28 times larger than that of Switzerland.

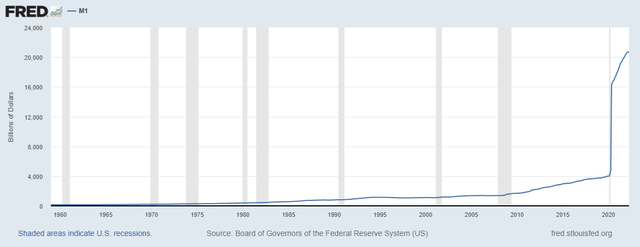

United States M1

The monetary policy measures taken by the U.S. after the 2008 financial crisis were unprecedented in history and helped the country avoid a disaster like in ’29. However, just when the financial crisis was long gone, a black swan called Covid-19 arrived. The temporary freeze in the world economy led the Fed to print an unprecedentedly large amount in such a short time, and to date there are many economists who believe the situation has reached a point of no return. Beyond any personal considerations, there is no question that the growth of the M1 monetary aggregate has been off the charts.

U.S. M1 (Federal Reserve Bank of St. Louis)

Personally, unlike some investors such as Michael Burry, I do not believe that this will lead to hyperinflation, but at worst to high interest rates like the 1980s with a subsequent recession. From January 2020 to December 2021 the M1 aggregate increased by 411%, certainly not a reassuring increase if inflation is to be kept low.

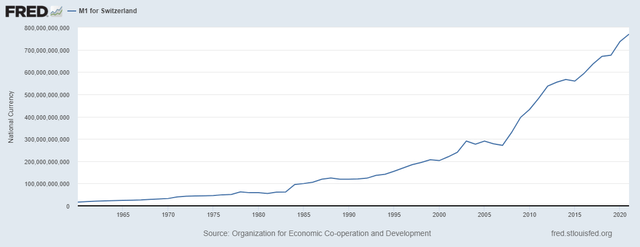

Switzerland’s M1

Switzerland as well as the U.S. has also employed an expansionary monetary policy since the 2008 crisis, sometimes reaching negative interest rates. At the time of the pandemic outbreak, a further increase in M1 was inevitable, but by no means comparable to that of the U.S.

Switzerland M1 (Federal Reserve Bank of St. Louis)

From 2019 to 2021, the M1 aggregate grew by 14%, certainly a more reasonable increase. How was it possible to achieve such a low increase compared to the U.S. if the pandemic also hit Switzerland hard? There are two main reasons:

- Switzerland’s fiscal policy was reasonable and very well thought out unlike the US. The Swiss government has helped the hardest hit sectors of the pandemic such as tourism more, but without going overboard. In fact, Switzerland’s debt-to-GDP ratio increased slightly by 2.3% from 2019 to 2021 and as of today stands at 41.4%. In the U.S., on the other hand, government aid not only was significantly larger (relative to GDP), but it affected virtually every sector of the economy. Every small business could benefit, even those who did not need the money. While the fiscal stimulus helped many struggling businesses, there were many others who took advantage of it. The U.S. debt-to-GDP ratio rose from 106.94% in Q4 2019 to 123.39% in Q4 2021. Since this ratio is 3 times higher than Switzerland’

s, the US will suffer more than Switzerland if the cost of debt increases. - The second reason mainly relates to the smaller contraction that the Swiss economy experienced during the pandemic. Based mainly on the service sector and with already developed teleworking, Switzerland was able to cope with the pandemic without necessarily reducing its economic activity too much. Therefore, it was not necessary to take on a lot of debt to support the whole economy.

As a result of these considerations, I think Switzerland has handled the pandemic much better and as of today is in a better position than the US. The U.S. fiscal policy has been sloppy, and it is paying the price for this negligence. In contrast, Switzerland has shown better management of its resources and benefits from a significantly lower debt-to-GDP ratio.

Inflation and interest rates in the U.S.

Inflation is currently the main problem in most developed economies not only in the US. The reasons for such high inflation cannot be attributed to a single event, but to a multiplicity of events. For each country the reasons behind high inflation are the same, what changes is the intensity of the events that triggered inflation greater than 2%.

- The first reason relates to the supply chain slowdown as a result of forced shutdowns to slow the spread of the virus. Covid-19 slowed if not completely halted international trade, and this led to significant price increases for products whose supply was particularly limited. While this problem has affected all major countries, it has not had the same intensity in each. The U.S. is the country most exposed to supply chain-related problems because of its heavy reliance on the import of Chinese products.

- The second reason was the prolonged injection of liquidity into the system even when inflation was continuing to rise. In my opinion, monetary stimulus should have been less and interest rates should have been raised earlier.

- The third reason can be attributed to the outbreak of the war between Russia and Ukraine. This event only exacerbated the inflationary pressures already in place due to the sharp rise in commodities, especially oil and wheat. Sanctions against Russia have had a boomerang effect affecting the U.S. and especially Europe. Inflation in the U.S. is at 40-year highs and oil prices remain very high.

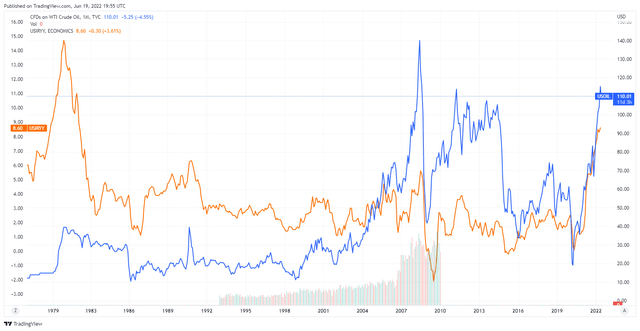

Comparison between oil prices and inflation (Trading View )

It can be seen from this graph that high levels of inflation have frequently been driven by high oil prices, consequently often leading to an economic slowdown, if not a recession. As of today, with the S&P500 down more than 20% and Q1 GDP negative we may have already entered a recession.

Despite a still low unemployment rate of 3.6% currently the U.S. economy is going through a very complex period and could last for months if not years yet. With the current inflation rate at 8.6% and a GDP that is struggling to grow, it would seem that we have entered a period of stagflation. Finally, I would like to express my opinion about what I consider the most important asset of central banks: credibility. The Fed showed from the beginning that it underestimated the problem of inflation by calling it temporary and continuing QE uninterruptedly.

To date, we are faced with structural inflation at 40-year highs and rising month after month: I do not think the Fed has handled the whole situation as well as it could. The credibility of the Fed has been questioned many times since their forecasting ability has not been the best. With the latest 75 basis point hike, the FOMC has signaled its willingness to tighten monetary policy quickly, but will it be enough to calm inflation? The FOMC’s forecast of the Fed Funds Rate in 2022 is 3.4%, still too low in my opinion against 8.6% inflation that has not peaked yet.

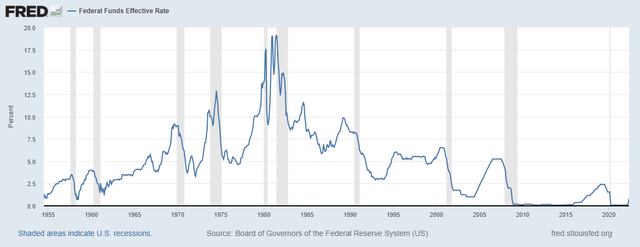

Fed Funds Rate (Federal Reserve Bank of St. Louis)

Considering the historical values of the Fed Funds Rate, 3.4% is not that high. At the same time, however, if inflation continues to rise, a Paul Volcker-style increase in interest rates would almost certainly lead to a recession due to the rising cost of borrowing. The Fed has reached a point of no return and as of today faces a fork in the road: either let inflation run its course with the risk of excessively devaluing the dollar or cause a recession by raising interest rates to stop inflation.

The latter scenario, by the way, must also be questioned. Will restrictive monetary policy really be effective in calming an inflation that mainly comes from supply and not demand? How will higher rates reduce oil prices and supply chain problems? Raising interest rates among other things does not have an immediate effect on the economy, so inflation may continue to rise.

Inflation and interest rates in Switzerland

The first major difference with the U.S. is an inflation rate that is still under control, in fact it is currently 2.9%. The SNB’s target is the same as the ECB and the Fed’s, between 0% and 2%, so it is slightly higher. The reasons why inflation is currently above its target are the same as in the U.S., but it is currently a more manageable situation. How has this been possible?

- First of all, supply chain problems have had a minor influence in Switzerland. Countries with a positive trade balance are those that have suffered the least from supply chain problems, and Switzerland is one of them. The U.S., on the other hand, historically has a negative trade balance, so it needs many imports to sustain its country’s economic activity. Dependence on China is very high.

- As explained earlier, Switzerland’s fiscal policy has been far more specific and reasonable than that in the US. With inflation not too high today, Switzerland will be able to make a gradual increase in interest rates, unlike the U.

S., which will have a greater urgency to raise them as soon as possible. - Switzerland is a country that has been committed to reducing its dependence on fossil fuels in recent decades; therefore, the increase in energy commodities has not affected the country as much as Europe and the US. The country is poor in fossil fuels but rich in water: 57% of its domestic electricity production comes from hydropower. Again, the best economies in the world should learn from the forward-looking policies adopted by Switzerland.

Overall, the SNC has a wider range of maneuvering than the Fed and can afford to keep interest rates still negative. On June 16, the SNB decided to raise its target interest rate by 50 basis points to -0.25%. If the SNB can afford to still have negative rates, it is also because of the nature of its currency. The Swiss franc is considered one of the safest currencies in the world and a safe haven asset when there is turbulence in the financial markets.

Since we are in a time of uncertainty where the Swiss franc is appreciating against major world currencies, the SNC is in no hurry to raise interest rates in order to increase demand for Swiss francs. With a strong currency and low interest rates, Swiss companies can still finance themselves and innovate at affordable interest rates thus gaining a considerable advantage.

Thus, from this U.S.-Swiss comparison we can see that the approach used for tight monetary policy is very different between the two countries, and this is mainly due to the different levels of inflation.

Yield curve comparison

The study of the yield curve is critical to understanding the medium- to long-term outlook for an economy. Typically, a flat or even inverted yield curve has implied a recession or economic slowdown. It is logical to expect higher interest rates for longer-term maturities, and when the reverse happens it can be a red flag.

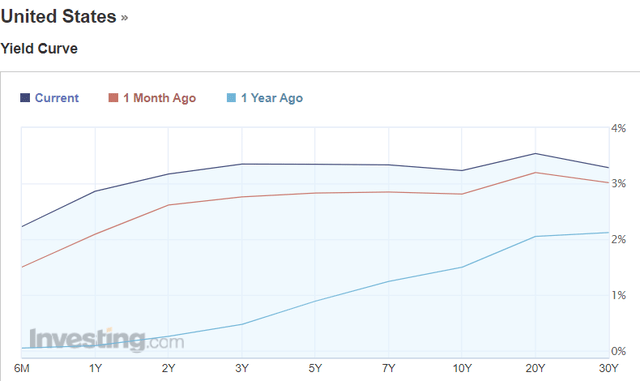

U.S. Yield Curve (Investing.com)

This is the U.S. yield curve, and it is easily observed that yields are flat. What is more, over the past year, short-term rates have risen much faster than long-term rates: if this trend were to continue, the yield curve would be inverted in a matter of a few months.

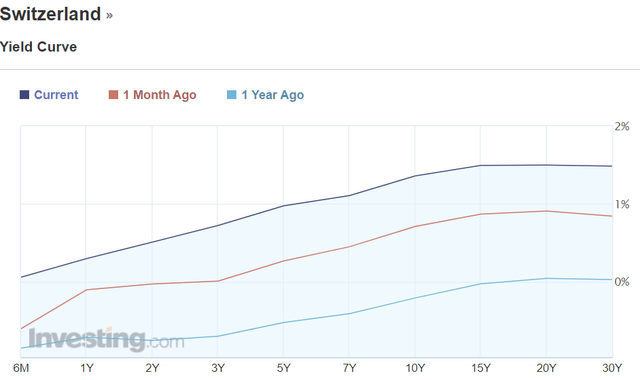

Switzerland Yield Curve (Investing.com)

Switzerland’s yield curve has no anomaly: higher maturities are associated with higher yields.

Comparison of the 3 main ETFs: SPY, EWL, QQQ

Up to now we have talked about the economic and financial differences between Switzerland and the US, but how they have performed in the financial markets since 2000? To make a comparison I will use for Switzerland the iShares MSCI Switzerland Capped ETF (EWL) while for the U.S. the ETFs SPY (SPY) and QQQ (QQQ). The SPY is the main ETF replicating the S&P500 (SP500), while the QQQ is the main ETF replicating the Nasdaq.

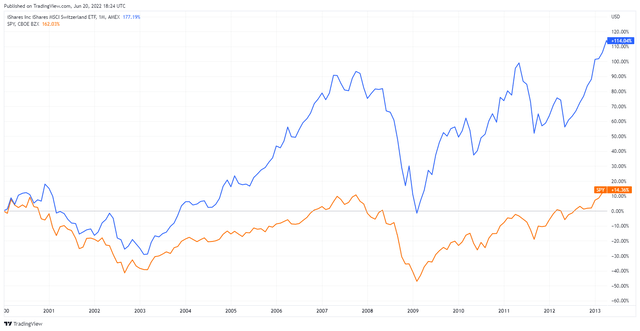

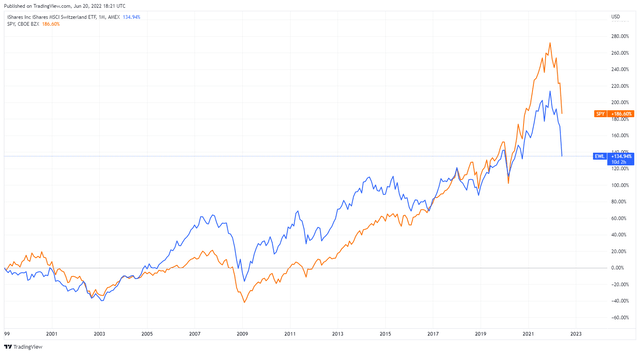

Comparison between EWL and SPY (Trading View )

As can be seen through this first chart, the EWL vastly outperformed the SPY from 2000 to 2013. What has been regarded as “the lost decade” for the U.S. stock market has instead been quite positive for the Swiss. The reason for such a wide gap lies in the resilience of the Swiss stock market: crashes are like the U.S. stock market but the speed with which losses are recovered is greater. The years from 2000 to 2013 were full of uncertainty, and in that case, it would have been better to invest in the Swiss stock market.

I personally find that there are currently several similarities to the lost decade, and what happened 20 years ago could be repeated. The exorbitant prices that some U.S. companies traded at unreasonable multiples reminds me a lot of what happened with the dot-com bubble in terms of overvaluation.

Despite these excellent results from Switzerland looking at an even longer time horizon, however, the situation changes completely.

Comparison between EWL and SPY (Trading View )

Over a period of 23 years, the performance of SPY was better than EWL. But what was the reason for this difference? The main reason is because of the tremendous growth of the U.S. tech sector, which trailed the S&P500 index to a sensational performance from 2009 to 2021. The growth was so rapid, however, that it led the index to be highly overvalued and to date it is paying the consequences. EWL is also having significant losses, but I don’t think it is as overvalued as the S&P500, so I expect the returns of the two ETFs to match in the not-too-distant future.

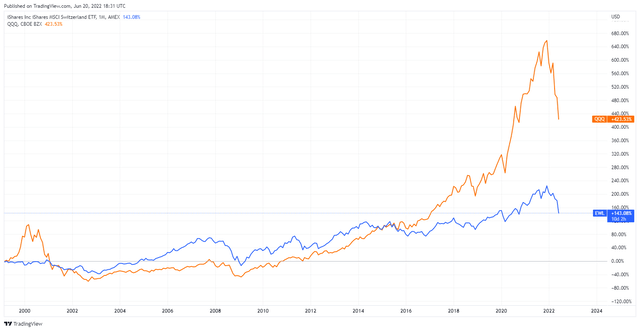

Comparison between EWL and QQQ (Trading View )

Looking at this other chart, it is even more evident how the tech sector has had abnormal and certainly unsustainable returns in recent years. The spread between the Nasdaq and EWL has never been this wide except during the dot-com bubble crisis. I do not expect this spread to turn negative as it did during the early 2000 crisis, but I do expect it to narrow, thus resulting in a better performance of the EWL than the Nasdaq. There is still a lot of downside room for the Nasdaq, but not so much for the EWL. From a very long-term perspective, the U.S. stock market may perform better, but in times of crisis and bursting of financial bubbles, EWL has proven to be a better investment.

In conclusion, I would like to make one last point. The purpose of th

is article is not to put the entire U.S. economy in a bad light in favor of the Swiss economy, but to consider new countries in which to invest in order to diversify the portfolio even more. In times of market uncertainty, I believe that having a diversified portfolio is crucial, and I have explained why I think Switzerland may be a good choice. Although I still consider the S&P500 to be overvalued despite the recent crash, that does not mean that there cannot be individual undervalued U.S. companies that you can currently buy at a discount.