Editor’s note: Seeking Alpha is proud to welcome Heretica investments as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Not S&P Global’s headquarters ljubaphoto/E+ via Getty Images

As the saying goes, nothing is certain except two things: death and taxes. I add to that trustworthy credit ratings. Credit ratings, data and indices will be in growing demand for many centuries to come. This, as well as several growth trends make S&P Global (NYSE:SPGI) a stable but sure place to invest for the long term although this may not be the case currently due to rather expensive equity valuations. Therefore, at a further meaningful dip in the stock price, the company’s stock will be worth picking up.

Overview of S&P Global

S&P Global inc., through its many subsidiaries, provides data, credit ratings, indices, research, analyses and even educational material to many institutions and firms globally. Although S&P Global have quite diversified activities across sectors and countries, it is best known as the most prominent of “the Big Three“ credit rating agencies in the world and also as the operator of the most famous financial indices, such as the S&P 500 (Standard and Poor’s 500) and DJIA (Dow Jones Industrial Average), both of which it has been operating for well over 100 years.

Q1 2022 earnings

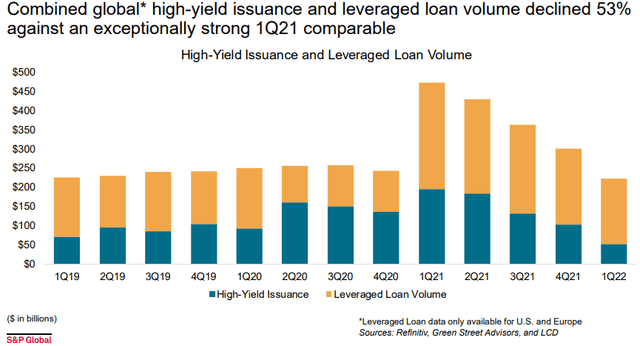

S&P Global’s recent earnings may not look like much compared to last quarter’s as they essentially were the same on a diluted EPS basis. The EPS was $2.89 vs $2.88 last quarter which is actually more impressive considering a broader slowdown in general debt issuance globally due to tighter financial conditions around the world. This is especially prevalent in the high yield bond markets where issuances have cooled off by 53% versus a year ago. The following bar diagram can be found in S&P Global’s newest earnings report. It shows the mentioned change in high yield debt and leveraged loan issuance:

S&P Global’s newest earnings report

It is also noteworthy that S&P Global completed their merger with IHS Markit inc., an information and data provider already a result of multiple mergers. According to a letter from S&P Global CEO Douglas L. Peterson, the merger will create more unique data insights for customers and increase S&P Global’s ability to provide ESG ratings.

Revenue Breakdown

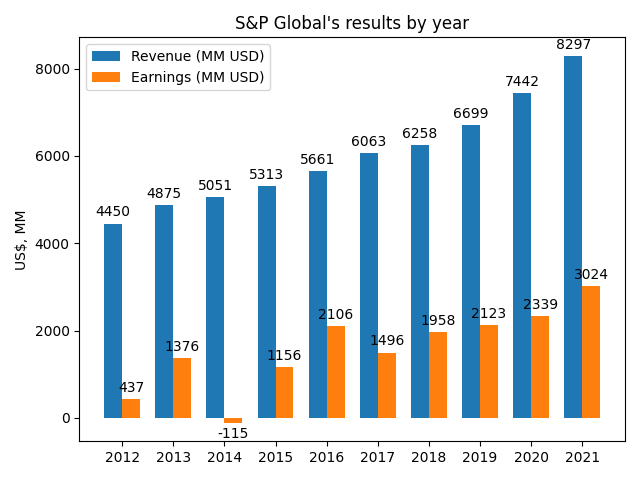

More specifically regarding its financials which can be found here, in 2020, 46% of S&P Global’s revenues came from their ratings division, S&P Global Ratings, 29% from the division Market Intelligence, 13% from their commodity insights division, Platts, and lastly, 14% came from their indices unit. The company has also seen its revenues grow steadily in the range of 3.61% to 11.5% YoY in the last 10 years whereas its earnings have seen more volatile fluctuations but nevertheless has seen steady growth of on average 27-28 YoY%. In the following bar chart, S&P Global’s results as retrieved from Morningstar can be seen:

S&P Global’s financials (Data from Morningstar.com)

Index-investing

Now, S&P Global is benefitting from several secular trends, whereas one of them is the popularity of index-fund investing/passive investing. This has been and still is a huge tailwind for S&P Global’s Indices division, as ever more people around the world are opening up investment accounts and index-style investing expands in popularity. This will give S&P Global the opportunity to grow the revenue gained from the indices-division. Another advantage of being able to grow the indices-division is its high profit margin of 60-70%.

Another trend benefitting S&P Global’s ratings division is economic growth in emerging markets. This will increase the Total Addressable Market for ratings, as more companies will need a reputable credit rating to issue debt or equity.

ESG

As of recent, much focus has been put on the environmental, social and governance (ESG) dimension to investing and companies in general. This could be where a substantial part of S&P Global’s future earnings growth comes from, as the idea of ESG-ratings is still in the early stages although many exchange-traded funds and investment vehicles already boast of being ESG-friendly. There is even potential for ESG-ratings being mandatory by law in the near future.

Commodity pressure

One thing currently halting the ESG-transformation of the investment- and corporate landscape is Russia’s invasion of Ukraine in conjunction with other supply chain disruptions, mainly stemming from the covid-19 aftermath. These are for many regarded as the explaining factors behind recent price increases and shortages of many products but more importantly for S&P Global, they might offer an increase in the demand for their commodity insights division, Platts, as the investment narrative shifts to also include more tangible businesses. On the other hand, should a substantial economic slowdown happen and commodity prices fall, the narrative pendulum might benefit the shift to ESG as it did in 2020 and 2021, assumed that the central banks relax monetary policy materially.

Data

In recent decades, the world has seen the rise of HFT (High Frequency Trading) and Quantitative Hedge funds. It would be reasonable to expect this kind of trading to become even more popular and due to the fact that these are very data-intensive, it would also be reasonable to expect solid growth for S&P Global’s Market Intelligence unit which both provides and analyses data of all kinds.

Moat and competitors

In the American credit rating space, 5 firms in total are designated NRSROs (Nationally Recognised Statistical Ratings Organisation). Furthermore, only three of these hold a collective 95% of the world’s credit rating market. Of this 95% market share, both S&P Global and Moody’s hold about 40% respectively, whereas Fitch has about 15%. With so few players in the industry and the evidence from the 2008 subprime mortgage crisis, it is fair to consider the industry an oligopolistic market, ie. the rating agencies have a lot of pricing power because of little competition. Also, because of the NRSRO designation, the american ratings market is quite hard to break into as a new player. Although this is boding well for the Big Three ratings agencies, it also works against them in places like China where certain policies make chinese rating agencies more competitive in comparison to foreign ones.

On the indices division, S&P global has a similar moat but competes with MSCI (MSCI), FTSE Russell (subsidiary of London Stock Exchange Group (LDNXDF), Bloomberg and even Nasdaq (NDAQ). The indices are many but the most used are those managed by S&P Global: S&P 400/500/600, S&P GSCI, the SPDR sector indices and many more. Also, S&P Global’s indices has been operating since 1882 which means there exists a lot more price data as compared to other index providers.

Risks

Since it is a while since S&P Global and IHS Markit merged, it is safe to say that the risk of S&P Global’s stock going down as is usually the case with the acquiring company’s stock has disappeared. Both S&P Global and IHS Markit were both quite large premerger and it might prove to be too hard a challenge to integrate the two businesses properly in the near future. Also, it is to be expected that S&P Global will allocate significant resources to combining the companies properly which will impact the bottom line.

Another risk though to S&P Global’s main business of credit ratings is the cyclicality of credit issuance which seems likely to turn lower during the last part of the year due to the increased cost of capital that often arises with a rising federal funds rate. These tightening financial conditions have historically also impacted investors which decrease financial activity in general and hurt S&P Global as this is what they mainly profit off.

Tightening financial conditions also pose a risk to the general stock market, including S&P Global’s stock which may see its valuation multiples compress as a result.

Valuation

A simple and reasonable valuation of S&P Global would at best be achieved by discounting their free cash flows back instead of valuing the equity in the business as much of their business stems from intangibles, such as brands, indices and data.

This requires us to estimate with how much S&P Global’s revenue can grow.A quick search can reveal that the credit ratings industry has grown by about 4.2% per year during the last five years according to industry research bureao Ibisworld. This also seems like a fair estimate for S&P Global’s financials as they are a large player in a mature industry but they are also well positioned to benefit from the need of sustainability ratings.

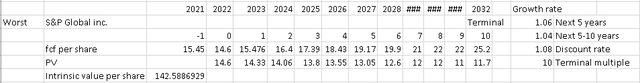

In the following 3 examples, I have therefore assumed a growth rate of 6% of their free cash flow per share for the first 5 years and a growth rate per year of 4% for the subsequent years. As of May 14th, S&P Global’s price/free cash flow amounts to about 22 or a free cash flow yield of 4.5% which the market may be willing raise or lower in the future depending on general levels of exuberance in the stock market. Also, I will use 8% as my discount rate although one might replace this with S&P Global’s actual weighted average cost of capital. Furthermore, I will use an average of S&P Global’s last (fcf) per share because, as Ben Graham once said, “Don’t take a single year’s earnings too seriously”. This amounts to 14.6 free cash flow a share.

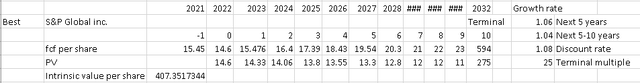

Best case scenario

The best case scenario is one where the market will continue to pay high multiples (25 price/fcf) and everything goes according to plan earnings-wise:

Data from morningstar.com. Made in Excel

Here, the company’s stock price amounts to 407 USD which indicates an upside of about 20% from the current price of (as of writing) 337.

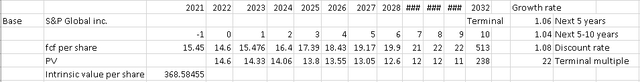

Base case scenario

In the next scenario, the multiple is the same as what the market currently has for S&P Global which is 22:

Data from morningstar.com. Made in Excel

This indicates an upside of about 9.5% from current levels to 368.6.

Worst case scenario

The following scenario is one where the market will pay a terminal multiple of 10:

Data from morningstar.

com. Made in Excel

In this scenario, a downside of about 46% all the way to a price of 142.6 per stock is in the cards.

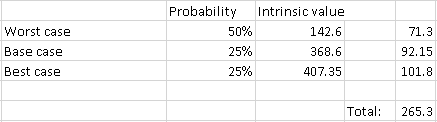

One way to condense predictions like these is to assign probabilities to them. Since I am of the belief that current macro conditions such as the recently inverted yield curve, the Evergrande crisis, the impact of rising yields and the inflation story will continue to weigh on stock market participants’ ability and willingness to purchase stocks for a while, I would give at least a 50% chance of the worst case scenario happening and 25% to the other two respectively:

Data from morningstar.com. Made in Excel

Conclusion

Although I see S&P Global’s business model as solid even through a recession, I would probably search on for a place to allocate capital currently as the exit multiple demands of the market are still quite high at 22 for S&P Global’s stock. Having said that, S&P Global does seem to have several growth tailwinds that they are and will be benefitting for a long time to come and they have a serious moat around their core businesses. Personally, I think S&P Global is a stock worth holding for the long term as it is a good quality business with an expandable moat. I would therefore not be afraid to accumulate a position in the company if they should pass even lower someday.