Parradee Kietsirikul/iStock via Getty Images

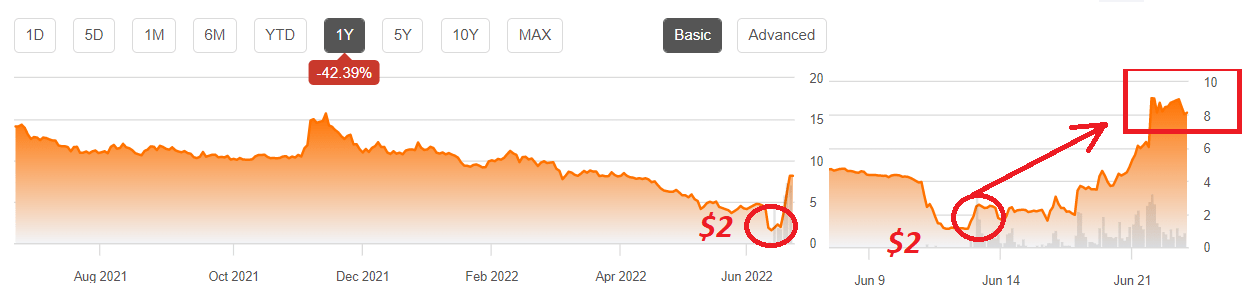

Revlon, Inc. (NYSE:REV) surprised the market with several deals with debt holders, which made the stock price spike up from $2 to around $8 per share. I understand the optimism about the stock, but I invite investors to be cautious about the stock. Without sufficient innovative beauty products in the new collections and no agreements with debt holders, REV could be overvalued. Under my DCF model, the sum of future free cash flow projections until 2030 is lower than the total debt obligations due from 2023 to 2025.

Business Model

Founded in 1932, Revlon, Inc. is the owner of several brands and seller of cosmetics, skin care, fragrance, and personal care products. Revlon’s brands include American Crew, Elizabeth Arden, CND, or Almay, which could be valued at millions of dollars because of the money invested in marketing throughout the years.

Company’s Website Company’s Website

With the presentations being done, let’s note that Revlon became quite an interesting stock after jumping from close to $2 in June 2022 to around $8. Before I deliver the information that made the stock jump, have a look at the company’s stock charts.

SA

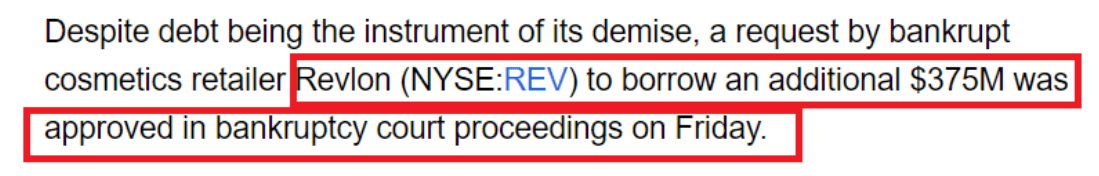

In June, Revlon delivered information about new borrowing facilities worth $375 million, which in my view, may explain the recent price dynamics:

SA

The story does not end here. In another press release, Revlon noted a new $575 million in debtor-in-possession financing. I do appreciate the optimism exhibited by market participants. However, I believe that investment research appears necessary to explain the current financial situation. Considering the total amount of debt, in my view, the current valuation is difficult to justify.

Upon receipt of court approval, the Company expects to receive $575 million in debtor-in-possession financing from its existing lender base, which in addition to its existing working capital facility, will provide liquidity to support day-to-day operations.1 The strong support by the Company’s lenders will help the business manage through current macro-economic challenges and in turn enable it to better serve customers. Source: Revlon Takes Step Towards Reorganizing Capital Structure as the Company Continues to Execute Against its Strategic Plan

Even considering recent words of management about the strong consumer demand reported in June 2022, investors have to carefully understand the current capital structure:

Today’s filing will allow Revlon to offer our consumers the iconic products we have delivered for decades, while providing a clearer path for our future growth. Consumer demand for our products remains strong – people love our brands, and we continue to have a healthy market position. But our challenging capital structure has limited our ability to navigate macro-economic issues in order to meet this demand. Source: Revlon Takes Step Towards Reorganizing Capital Structure as the Company Continues to Execute Against its Strategic Plan

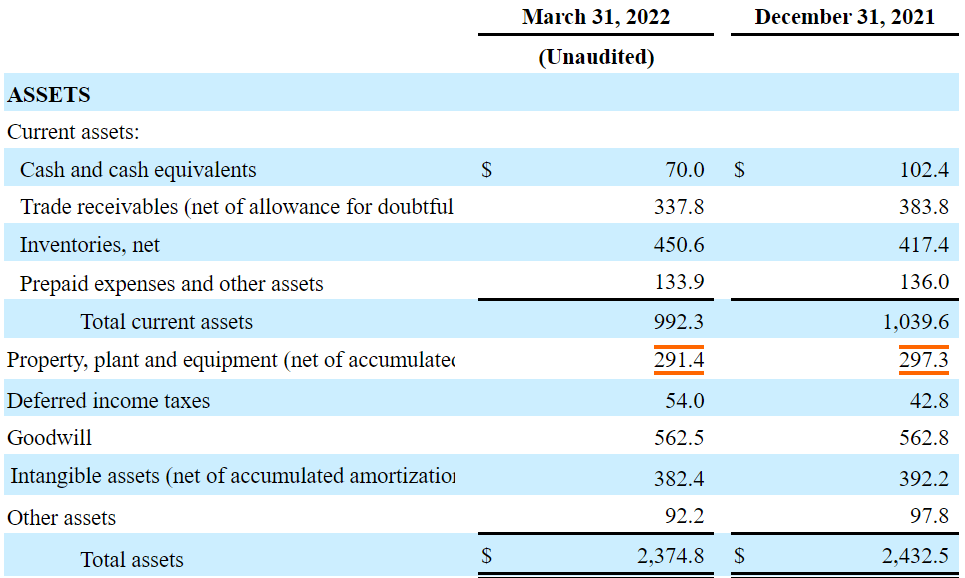

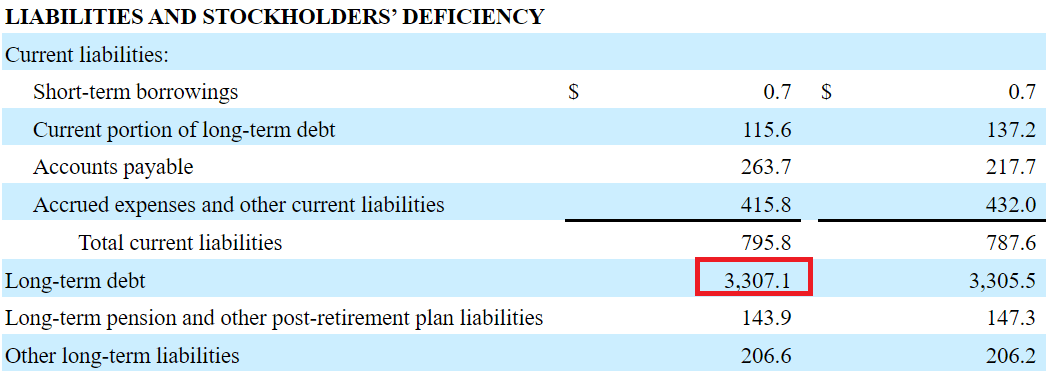

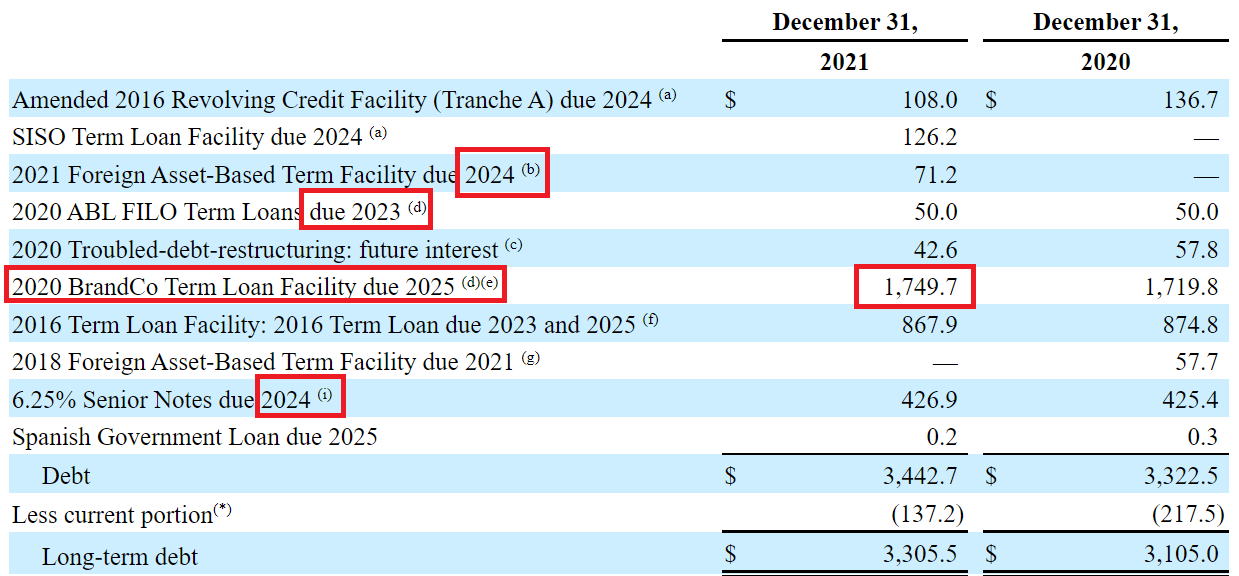

Balance Sheet: The Total Amount Of Debt Includes $3.3 Million In Long-term Debt

As of March 31, 2022, the company reports $2.3 billion in total assets and $3.3 million in long-term debt. The company’s balance sheet does not look good at all. We are talking about a company that is going through a reorganization process because of its level of debt. The reorganization received so much attention by the market that I decided to conduct research on the company.

10-Q

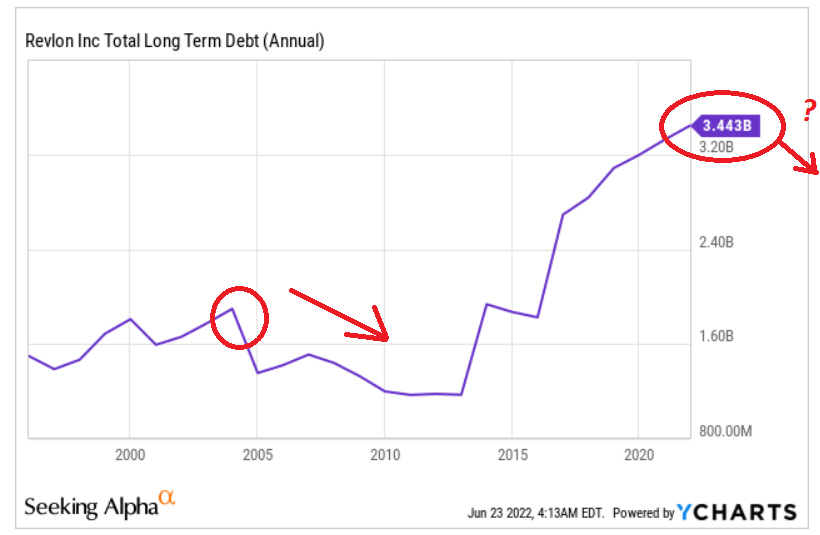

Optimistic investors may say that the company may be preparing to reduce its long-term obligations as it happened in 2005. With that, in my view, it appears relevant noting that Revlon didn’t decrease its long-term debt in 2022.

10-Q YCharts

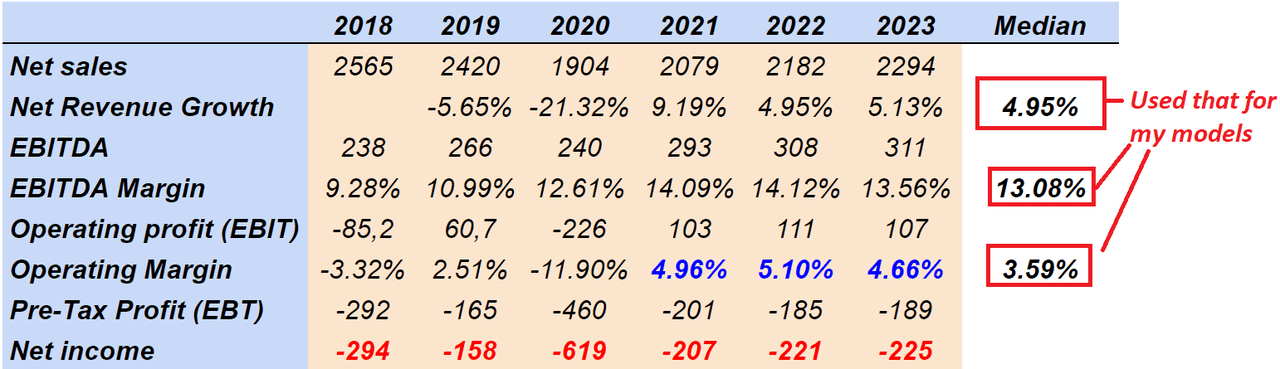

Assessment Of Net Revenue, EBITDA Margin, And Operating Margin

From 2018, Revlon’s net sales, EBITDA margin, and operating margin seem impressive. The median net sales growth stands at 4%-5%, the median EBITDA margin is close to 13%, and the operating margin is close to 3%-4%. Have a look at the figures reported by Revlon because I will use these figures in my financial models.

YCharts And Arie

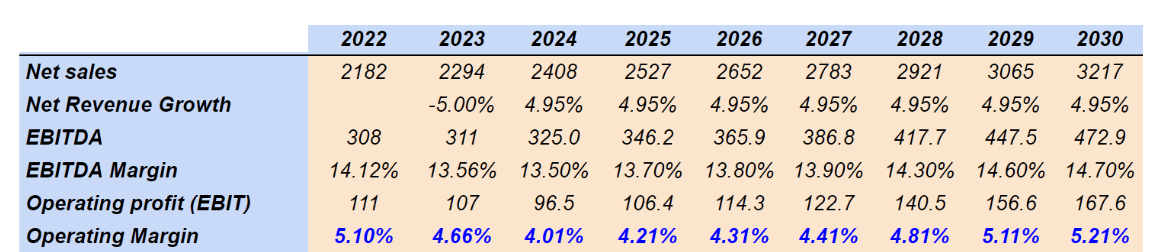

With sales growth close to 4.9%, an EBITDA margin of 13%-14.7%, and operating margin around 4%-5%, 2030 EBIT would stand at $167 million.

YCharts And Arie

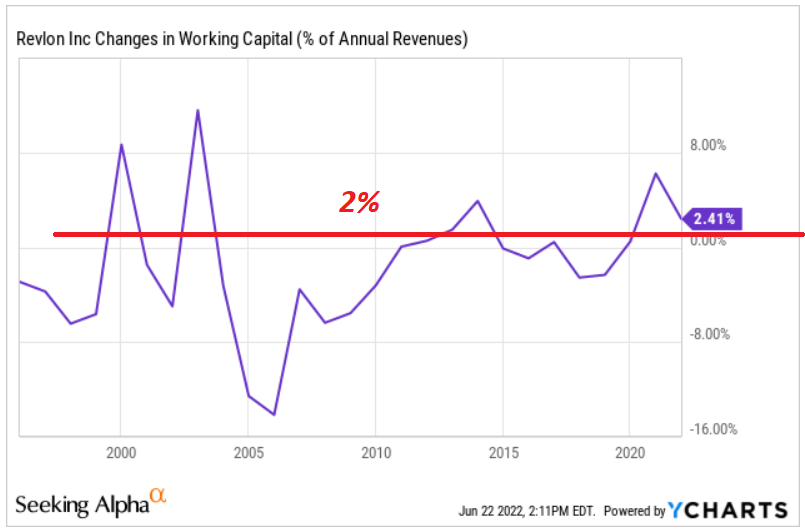

From the year 2000, changes in working capital/sales ranged from -16% to close to 8%. With this in mind, I believe that changes in working capital/sales around 2% appear reasonable.

YCharts

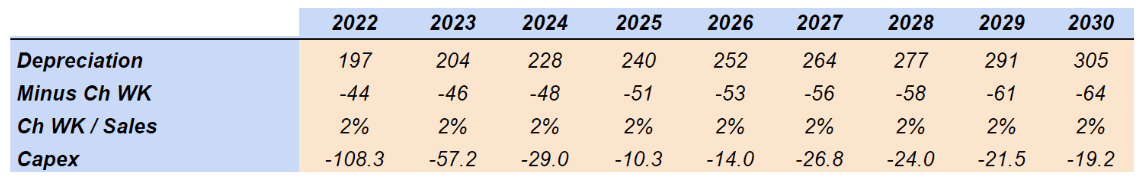

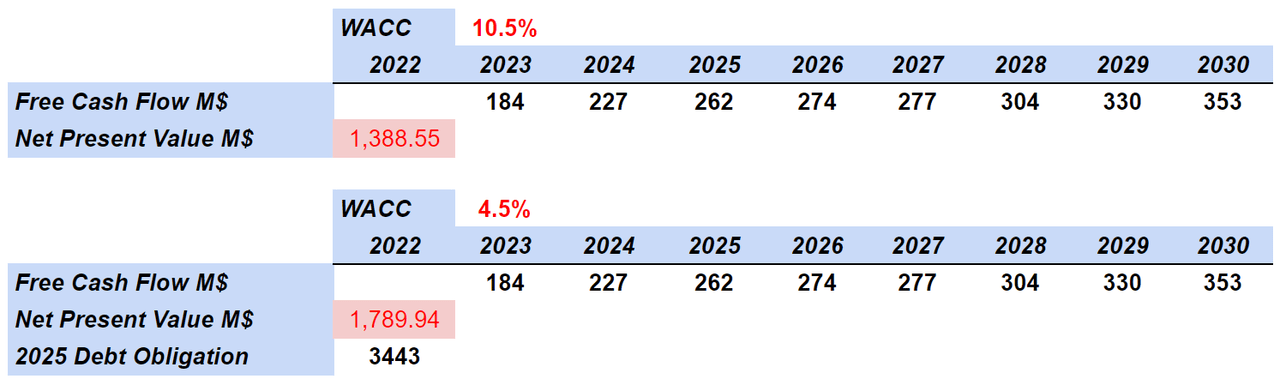

From 2022 to 2030, I assumed growing depreciation and amortization along with declining capital expenditure. My figures included 2030 D&A of $305 million, 2030 changes in working capital of $64 million, and 2030 capex of $19 million.

Arie Investment Management

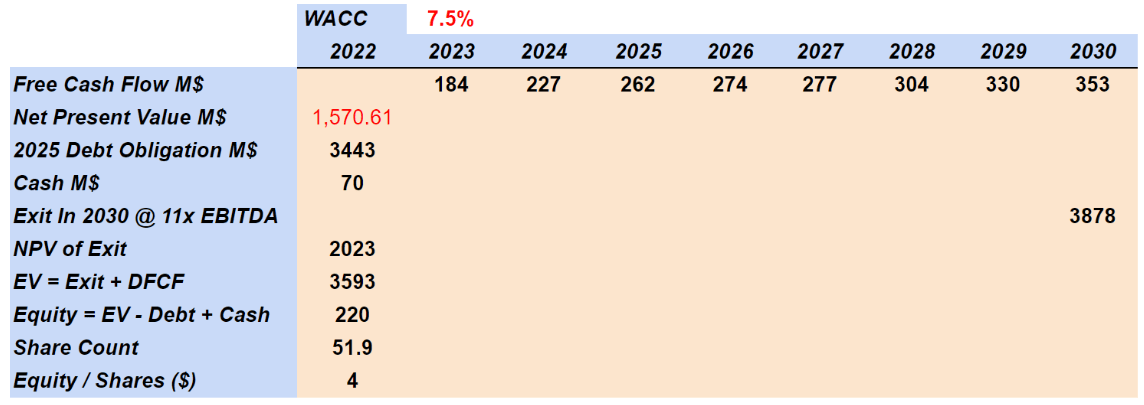

Let’s note that my free cash flow expectations seem overall very optimistic. However, the sum of free cash flow does not seem sufficient to pay the total amount of debt. The free cash flow that resulted from my assumptions included free cash flow close to $184-$353 million. Using a discount of 10.5%, the net present value of future free cash flow stands at $1.3 billion. If we become even more optimistic, with a discount of 4.5%, the implied sum of FCF stands at $1.7 billion.

Arie Investment Management

Revlon may have to pay close to $3.4 billion in 2023, 2024, and 2025, which is above the potential FCF that may be generated from 2023 to 2030. I really don’t see Revlon paying all its debts.

10-K

Valuation If Revlon Receives Additional Financing Or Debt Holders Offered A Deal

Under very optimistic conditions, Revlon will likely offer further innovation and more communication, which could lead to revenue growth. Let’s note that I am assuming that management will find new debt financing to run these activities. With the current amount of cash, I don’t believe that management is well-prepared to run operations like in the past:

Strengthening its iconic brands through innovation and relevant product portfolios; second, building its capabilities to better communicate and connect with its consumers through media channels where they spend the most time; and third, ensuring availability of its products where consumers shop, both in-store and increasingly online. Source: 10-Q

Besides, I assume that the company’s Global Growth Accelerator program will help the company improve its free cash flow m

argins. The result would be that more and more investors will have a look at the company’s financing performance:

The Company has continued to deliver against the objectives of the Revlon Global Growth Accelerator program, which includes rightsizing our organization with the objectives of driving improved profitability, cash flow and liquidity. The Company is also managing the business to conserve cash and liquidity, as well as focusing on stabilizing the business, growing e-commerce and preparing the foundation for achieving future growth. Source: 10-Q

Finally, I believe that Revlon could soon reach an agreement to sell some assets, which would bring a significant amount of cash. Let’s note that management is already exploring transactions:

MacAndrews & Forbes and the Company continue to explore strategic transactions involving the Company and third parties. Source: 10-Q

With a discount of 7.5%, which is more optimistic than that of other investment advisors, I obtained an implied enterprise value of $3.59 billion. Note that I am using an exit valuation of 11x, which is extremely optimistic for a company like Revlon. It has a lot of debt, so I wouldn’t be surprised if Revlon trades at 2x or even 4x EBITDA. Finally, the equity valuation would be close to $220 million. The implied share price would stay at around $4 per share.

Arie Investment Management

Inflation Risks And Lack Of New Products Could Also Destroy The EBITDA Margins, And Push The Stock Price Below $4

With inflation, Revlon’s EBITDA margin and free cash flow figures could decline significantly. If management cannot increase its prices without affecting the demand for its products, the EBITDA will likely decline. Supply chain issues or delays from raw materials suppliers would also affect the company’s operations. Revlon disclosed these risks in its last annual report.

The Company purchases raw materials, including essential oils, alcohols, chemicals, containers and packaging components, from various third-party suppliers. Substantial cost increases. Delays and the unavailability of raw materials or other commodities, as well as higher costs for energy, transportation and other necessary services have adversely affected and may continue to adversely affect the Company’s profit margins if it is unable to wholly or partially offset them, such as by achieving cost efficiencies in its supply chain, manufacturing and/or distribution activities. Source: 10-K

If Revlon does not design innovative beauty products, or clients don’t appreciate the new collection, revenue growth may decline. In the worst-case scenario, the company’s EBITDA margin would decline substantially, which could push the company’s fair price below $4.

The company has a rigorous process for the continuous development and evaluation of new product concepts, led by executives in marketing, sales, research and development, product development, operations, law and finance. However, consumer preference and spending patterns change rapidly and cannot be predicted with certainty. There can be no assurance that the company will anticipate and respond to trends for beauty products effectively. Source: 10-K

Takeaway

I understand the recent optimism about Revlon considering the new loans reported and negotiations with debt holders. If management reaches a deal and obtains more debt financing, the stock price may trend even higher. With that, without sufficient innovative products and no transactions with third parties, future free cash flow will likely not be sufficient to pay the total debt outstanding. Considering the results of my DCF model, I believe that the company is quite overvalued, and may trend lower in the near term.