adrian825

Intel Corporation (NASDAQ:INTC) and Taiwan Semiconductor Manufacturing Company Limited (NYSE:TSM) are two of the most successful semiconductor chip manufacturers in the world. While TSM basically manufactures chips for other companies including Intel, Intel’s revenue is at this point almost entirely proprietary with Intel CPUs dominating the market.

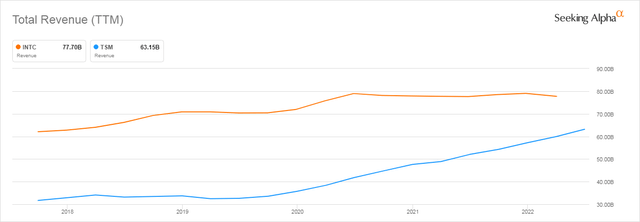

Looking at their 5-year revenue trends, both have increased their revenue but TSM’s increase has been greater and it has narrowed the revenue gap with Intel considerably. But with Intel’s relentless pursuit of generic foundry services similar to TSM’s, Intel’s revenue growth over the next 5 years will probably outpace TSM’s.

Seeking Alpha

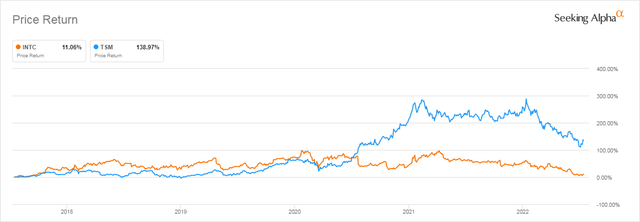

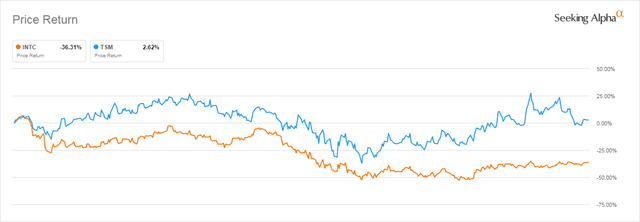

Year to date, both stocks have significantly dropped in price, TSM by 32% and INTC by 27%.

But over the last 5 years, TSM’s price has outpaced Intel’s price significantly by 138% to 11%.

Seeking Alpha

I have written 23 articles on Intel but none on TSM over the last 7-plus years. In many of those articles, I have compared Intel’s prospects with other chip companies including the most recent one comparing Intel to Micron (MU).

In this article, I will compare the current status of both companies and come up with an investment recommendation for both.

Financial metrics

Contrary to what we might guess from the introduction above, TSM and INTC have some considerable differences in key financial metrics.

One of the most noteworthy is the Market Value which shows TSM has a whopping 168% more Market Value (Line 6) than Intel even though it has significantly lower revenue (Line 2) and EPS (Line 10).

That could indicate either Intel is underpriced or TSM is overpriced.

But both have about the same Gross Margin percentage (Line 5), so no direct advantage there.

| Intel vs Taiwan Semiconductor | ||||

| Financial metrics | ||||

| In billions | ||||

| TTM results | ||||

| Line # | INTC | TSM | INTC vs TSM | |

| 1 | Stock Price 7/15/22 | 38.27 | 85.81 | -124% |

| 2 | Revenue | 77.7 | 63.1 | 19% |

| 3 | Price/Sales | 2.3 | 6.2 | -168% |

| 4 | Gross Margin | 42.2 | 34.7 | 18% |

| 5 | Gross Margin % | 54% | 55% | -1% |

| 6 | Market Value | 154 | 411 | -167% |

| 7 | Enterprise Value | 180.5 | 393 | -118% |

| 8 | GM to Mkt. Value | 27% | 8% | 69% |

| 9 | GM to Ent. Value | 23% | 9% | 62% |

| 10 | EPS | 6.06 | 4.95 | 18% |

| 11 | PE Ratio Current | 6.3 | 17.3 | -175% |

| 12 | Net Debt Current | 26.5 | -18 | 168% |

| 13 | EBITDA | 31.5 | 42.8 | -36% |

| 14 | Debt/EBITDA | 0.8 | -0.4 | 150% |

| 15 | FCF | 9.8 | 14.1 | -44% |

| 16 | Price to FCF | 15.7 | 29.1 | -85% |

| 17 | Annual Dividend | 1.41 | 0.37 | 74% |

| 18 | Dividend rate | 3.7% | 0.4% | 88% |

| 19 | Research & Dev. | 15.9 | 3.3 | 482% |

But the metrics look different when you compare them to the relative prices of the two stocks in terms of the GM (Gross Margin) percentage of MV (Market Value) and EV (Enterprise Value). In that case, Intel looks much better with a Gross Margin to MV and EV of 27% and 23% (Lines 7 & 8) compared to TSM’s rather paltry 8%.

That would indicate TSM’s stock price may be overvalued on a relative basis.

Overvalued may also apply to the P/E Ratio (Line 11) and Price to FCF (Line 16), both of which make Intel look underpriced relative to TSM’s current valuation.

However, over the last 5 years, TSM has consistently had a much higher Price/Sales even though Gross Margins are about the same between the two companies and Intel’s profit is much higher.

Seeking Alpha

And finally, I have added Line 19, Research and Development, to show how Intel spends almost 5 times more on R&D than TSM. TSM does not design chips, so its R&D is limited mainly to production improvements. Intel spends to keep its proprietary chips at the top of the heap while TSM’s much lower R&D number shows the commodity nature of its business mod

el.

This is an important distinction between INTC and TSM. Intel’s advantage is it manufactures most of its own chips in its proprietary fabs and thus has more actual experience in the chip business in its totality than TSM does. In other words, as INTC begins to compete in TSM’s market, i.e., just the fabrication part of chip production, it can offer customers access to its 70,000 chip design patents in addition to its production facilities. In some or most cases this would be a huge advantage and could actually expand its margins considerably.

In other words, Intel’s approach to new fab customers will be a combination of high-end production facilities plus a proprietary chip design kicker as needed.

For this reason and others, Intel thinks it can more than compete with TSM for future customers.

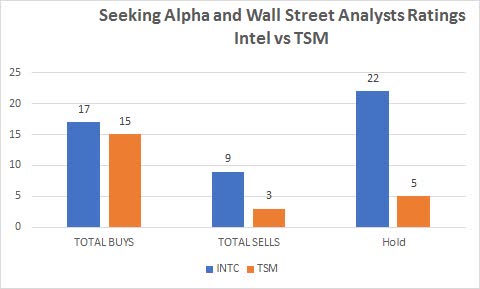

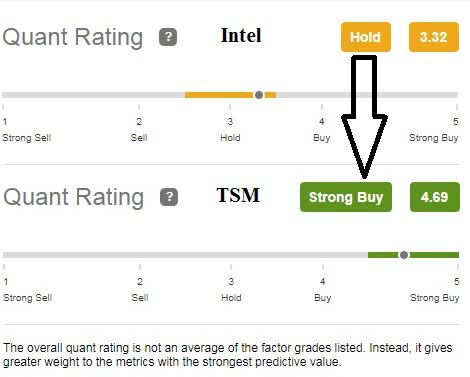

Analysts’ ratings are high for both INTEL and TSM.

If we look at Seeking Alpha plus Wall Street analysts combined, we can see that both stocks come highly recommended with a combined score of 32 buys and only 12 sells.

However, Intel’s huge 22 Holds show a certain lack of enthusiasm for their new approach. And their almost 2 to 1 Buy vs. Sell pales in comparison to TSM’s 5 to 1 Buy/Sell margin.

Seeking Alpha and author

The quants are even more certain TSM is the better stock with a Strong Buy rating as opposed to Intel’s mediocre Hold.

Seeking Alpha

TSM did better than Intel in the last recession

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

From December 2007 through June of 2009 was the last recognized recession period and TSM was about breakeven with a 3% share price increase over the period, while Intel did poorly down 36%.

So if you were to pick one stock strictly based upon recession performance, it would have to be TSM.

Seeking Alpha

Conclusion

The future is bright for both companies because the pursuit and production of new, smaller, faster, smarter, and more useful chips are relentless and ongoing.

Some of the markets such as AI (Artificial Intelligence) will grow at a 34% CAGR and brain-like chips by a staggering 94% CAGR.

That’s not to mention the two huge markets represented 5G and IoT demands.

The semiconductor market as a whole is projected to grow by $440 billion from 2021 to 2029.

The obvious investment question is whether now is the time to buy either of these two chip companies. Both have shown share price losses over the last 6-8 months in the face of continued logistics and market problems.

But since we are looking longer term out to 2025, I think we can assume those issues will be resolved by then.

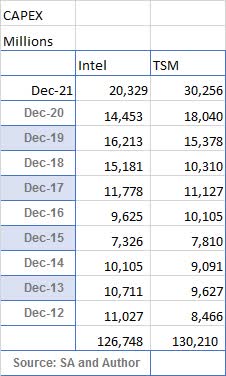

Intel’s goal to build new fabs all over the world will require massive CAPEX even more than their historically high CAPEX spending. TSM’s CAPEX over the last 10 years shows how expensive it is to constantly build new fabs to keep up with demand. In fact, TSM has spent more on CAPEX over the last 10 years than Intel has.

Seeking Alpha and author

I would say looking at a combined $250+ billion spending on CAPEX, only Intel and TSM have the margins and cash flow to compete for most of that $440 billion semiconductor revenue increase coming by 2029.

Therefore, I think we have to look at the other numbers to pick an investment choice for 2025.

Intel’s much lower market value makes it a value proposition compared to the much higher-priced TSM.

-

TSM’s price/sales ratio is 2.7X Intel’s.

-

Intel’s Gross Margin % to Market Value is more than 3X TSM’s.

-

TSM’s P/E ratio is more than twice Intel’s.

-

Intel’s price to free cash flow is about 1/2 TSM’s.

Not to mention Intel’s almost 4% dividend far outpaces TSM’s measly .4%.

Add in the unknown risk factor of China versus Taiwan, and Intel’s vast and superior IP (Intellectual Property) portfolio, I think the appropriate choice for 2025 is Intel.

Intel is a strong buy for those with a long-term investment horizon.

TSM is a hold.