The Might final results are in, and tools finance providers appear to be shedding confidence in the yr ahead.

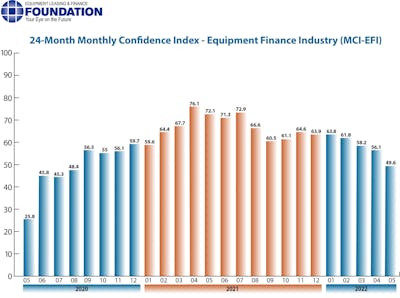

The Devices Leasing & Finance Foundation’s May well 2022 Every month Self-assurance Index is now at 49.6, a 6.5-stage reduce from the April index of 56.1, and a staggering 22.5-place drop compared to the exact same period final yr.

When asked about the outlook for the foreseeable future, MCI-EFI study respondent David Normandin, president and CEO of Wintrust Specialty Finance, said, “Adapting to adjust is what the products leasing field is all about. Our recent increasing-amount environment will be fantastic for the all round money well being of tools finance businesses as obligors adapt to the new world charge order and margin is constructed back again into the enterprise. I do think this will generate difficulties for several who may possibly not have a very long-term secure capital construction.”

Self confidence in the machines finance industry is 49.6 for Might 2022, a decrease from the April index of 56.1.Gear Leasing and Finance Affiliation

Self confidence in the machines finance industry is 49.6 for Might 2022, a decrease from the April index of 56.1.Gear Leasing and Finance Affiliation

- 6.9% of executives responding stated they feel company conditions will increase, down 14.8% from April.

- 10.3% of the survey respondents consider demand from customers for leases and financial loans to fund funds expenses will improve, down from 29.6% in the past thirty day period.

- 13.8% of the respondents anticipate additional obtain to cash to fund gear acquisitions, down from 22.2% in April.

- 48.3% of the executives report they anticipate to retain the services of a lot more employees, up from 40.7% in the former thirty day period.

- 3.5% of the leadership evaluate the present U.S. overall economy as “excellent,” down 14.8% from April.

Lastly, 69% of respondents consider financial disorders in the U.S. will worsen in excess of the upcoming 6 months, an boost from 40.7% in the former month.

Divided by market place segments, respondents were being as follows: banking companies, 58.6% captive finance, 13.8% and independent finance businesses, 27.6%

The index is a qualitative evaluation of important gear finance sector executives on the two prevailing business problems and upcoming anticipations, according to the foundation.