noel bennett/iStock Editorial via Getty Images

Dufry (OTCPK:DUFRY) (OTCPK:DFRYF) is the global market leader in travel retail. The Swiss company operates around 2,300 shops in 64 countries located at airports, cruise liners, seaports, railway stations, and downtown tourist areas across the Globe. The company’s retail brands include general travel retail shops under various names. Traveling around the World, Dufry’s shops offer food, wines, spirits, and also perfumes & cosmetics. It also sells watches, tobacco goods, souvenirs, books, and many other items. The company was incorporated in 1865 and is headquartered in Basel (Switzerland).

Business Overview

Dufry stores are mainly located in airports, which account for almost 84.2% of its turnover, hotels and tourist places for 3.8% as well as on cruise ships and seaports accounting for 2%. Railway stations reached 10% in 2021.

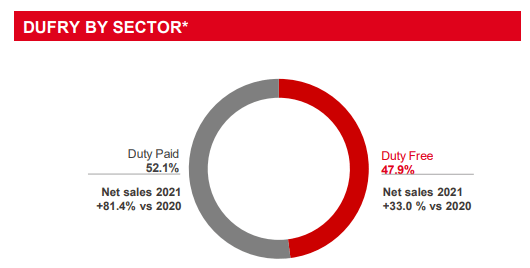

Dufry group revenue split can be broken down by type of shop:

- Tax-free or Duty-Free shops currently represent 47.9% of the group’s turnover.

- The other stores account for 52.1% of Dufry’s sales.

Dufry by sector

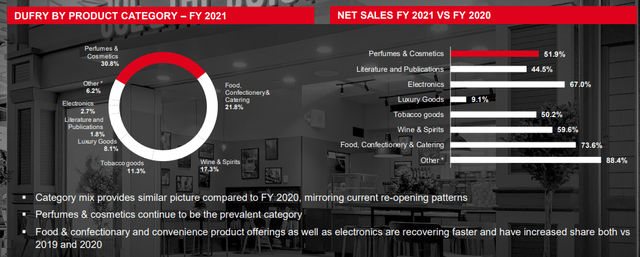

As regards the turnover breakdown, it is noted that perfumes and cosmetics generate 30.8% of total turnover, followed by confectionery and other food at 21.8% and wines & alcoholic beverages at 17.3%.

Dufry by product

Our Bet On Travel Recovery

Here at Mare Evidence Lab, we are now exposed to two sectors that we think will benefit from the COVID-19 recovery: the luxury fashion and the travel & leisure industries. Why are we bullish on Dufry?

- Strategic M&A during the pandemic outbreak, Hudson acquisition was a major milestone in North America. The company has over 1,000 stores at airports and major hub stops and tourist destinations. Hudson’s delisting is part of Dufry’s ongoing reorganization and aims to streamline its business structure while aligning its operations to the new business environment;

- Dufry structural cost savings that have been achieved during the pandemic. Our internal team believes that CHF 300 million out of CHF 400 million are permanent savings. The company has also used the early retirement programs and government assistance subsidiaries during the pandemic;

- Dufry has also decided to partner with the Chinese group Alibaba in order to explore and invest together in some opportunities in China to develop the travel retail business in the country and strengthen Dufry’s digital transformation. Under this agreement, the two companies will set up a joint venture in which the Chinese group will have a majority stake of 51% and Dufry, a 49% stake. Alibaba will bring its network to China and its IT capabilities while Dufry will bring its current travel retail business to China and support the new venture with its own supply chain and strong operational skills. In parallel, the Alibaba Group will invest in the travel retail specialist, holding a maximum of 9.9% of the capital. Access to the Chinese duty-free market would mark a major milestone for the Swiss company;

- Hainan’s new partnership has been signed with a company owned by the province of Hainan with the aim of developing travel retail on the Chinese island. The first step in this collaboration is the development of new tax-free infrastructure within the Mova Mall in Haikou, the island’s capital. The Mova Mall is one of the main tourist and commercial destinations in the city center of Haikou and offers a wide range of shops, restaurants and entertainment and over 2,500 luxury hotel rooms. The operation allows Chinese citizens to purchase up to $14,000 worth of products per year at tax-free rates;

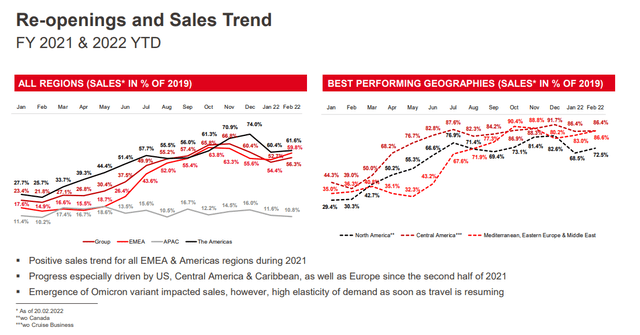

- Re-openings and positive trend confirmed. As of December, the company stated that: “around 1,900 shops globally were open, representing around 88% of sales capacity compared to full-year 2019″.

Dufry re-openings and sales trend

Valuation And Main Risks

Our internal team derived a target price of CHF 50 based on a three-stage DCF model with a WACC of 8% and a long-term growth rate of 2%. The stock is trading below our target price, and accordingly, we initiate with a buy rating. Very interesting to note is what the market is currently pricing:

- CHF 280 million of permanent cost saving;

- Full revenue recovery in 2024.

If we normalized the pre-COVID-19 cash generation, adjusted the operating cash flow margin at 13% with the structural saving guided by the management, the derived target price is even higher.

Major risks that could negatively impact Dufry’s stock price:

- Macroeconomic events;

- Worsening conditions from the current health crisis and further travel restrictions;

- Tourist flow destinations (more local and less abroad)

- FX in emerging markets;

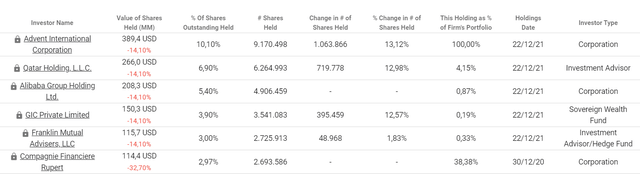

- An exit from the most important shareholders such as Alibaba (BABA) and Qatar Holding, who own respectively 5.4% and 6.9% of Dufry’s equity stake.

Source: TIKR; Dufry Shareholders structure

Previous coverage in the travel and leisure industry:

- Expedia: U.S. Exposure And Travel Recovery Will Play In Its Favour

- easyJet: Short Turbulences, Long Upside

- Ryanair: Our Bet On Travel Recovery