Constantinis/E+ through Getty Visuals

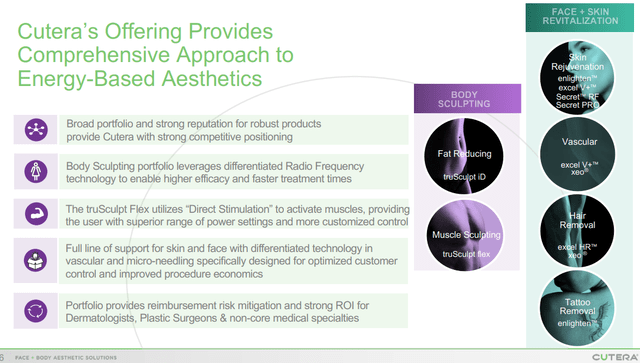

Cutera, Inc. (NASDAQ:CUTR) is a professional medical unit enterprise focusing on aesthetics as non-surgical remedies for pores and skin revitalization and human body sculpting. These are superior-stop gear including radio frequency micro-needling devices utilized by plastic surgeons, dermatologists, and other specialized clinicians.

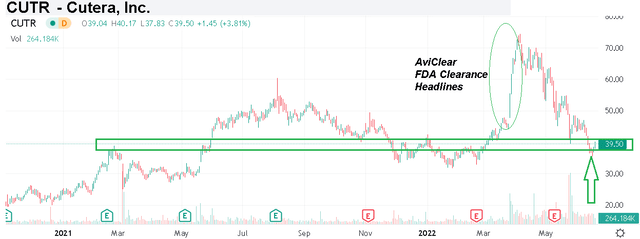

The attraction in this article is a recent Food and drug administration clearance for the company’s “AviClear” device as the first and only electrical power-primarily based pimples treatment that signifies a sizeable progress runway. When the stock in the beginning surged to an all-time substantial on the announcement, CUTR has due to the fact given up the gains amid the serious current market volatility. In fact, we feel this the latest pullback can represent a new shopping for possibility in a sector chief that maintains a beneficial extensive-time period outlook.

CUTR Financials Recap

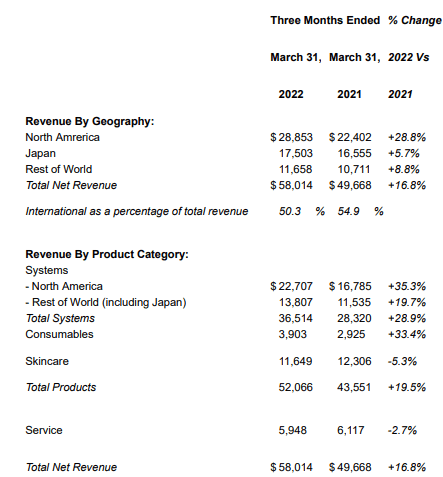

The company last noted its Q1 earnings on May possibly 10th with a GAAP EPS reduction of -$.84 for every share, as opposed to a net decline of -$.02 in the period very last calendar year. The story right here has been a soar in spending as the organization prepares to launch the Acne business. Complete operating bills climbed 69% y/y to $44.9 million which also provided AviClear expending and investments toward a new interior ERP program technique. The adjusted EBITDA decline of -$3.8 million in contrast to a good $4.6 million consequence in Q1 2021.

However, the earnings of $58. million was a Q1 quarter enterprise history, up 17% yr-around-year driven by toughness in units sales out of North The us up 35% y/y. This balanced a flat trend from Europe, in part impacted by the Ukraine crisis. For context, the business is practically equally split among North The usa as the core industry and internationally. Australia and Japan are also important areas that have been solid for the company.

supply: firm IR

Once again, the big growth previous quarter was the U.S. Meals and Drug Administration granting a 510k clearance for Cutera’s AviClear on March 25th. By this measure, the Q1 outcomes did not incorporate any AviClear contribution with an expectation for a full-scale professional launch later on this 12 months. The critical insight is that as opposed to present topical ointments or even alternate system treatment options, AviClear is regarded as getting long-lasting and productive. From the press launch:

AviClear is a laser treatment method that provides a risk-free, prescription-no cost solution for acne. In addition to lowering existing pimples, clinical trials display that long run breakout episodes are shorter, significantly less intense, and more rare adhering to the AviClear technique. Even further, acne breakouts clearance results proceed to enhance over time, demonstrating the prolonged-expression efficacy of this novel treatment method.

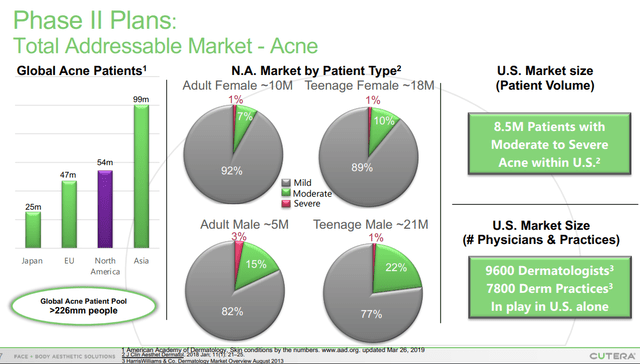

Cutera sees a industry chance of about 226 million folks worldwide and specially 8.5 million sufferers in the U.S. by yourself that are described as obtaining average to significant zits. Nearly 7,800 dermatology practices in the U.S. alone depict opportunity prospects. The business sees its “to start with mover” benefit with this line of procedure as delivering a rapid marketplace penetration about the next several years.

resource: corporation IR

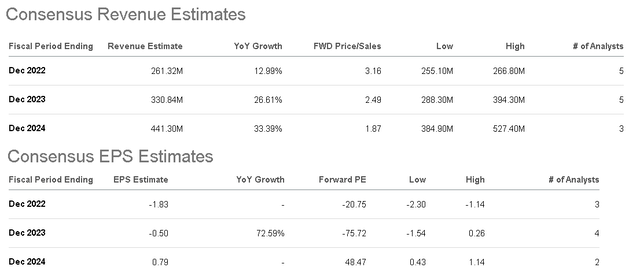

For near-expression direction, administration is reiterating the 2022 earnings forecast amongst $255 million and $260 million, representing an approximate continual forex development rate of 13% to 15% from 2021. This target particularly does not incorporate any contribution from AviClear which, in our see, opens the door for some stronger than envisioned developments into Q4 from early profits and into 2023 as the industrial rollout gains traction.

Lastly, we be aware that Cutera ended the quarter with $132 million in dollars and marketable securities versus $134 million in extensive-phrase financial debt as convertible notes. Management expects a continued hard cash burn up around the next number of quarters as it builds up its AviClear inventory but believes its liquidity posture is adequate to fund the development possibility for the foreseeable upcoming.

CUTR Stock Rate Forecast

What can make AviClear interesting in our view is that it represents a practical option to prescription-energy Isotretinoin “retinoids” class of chemical compounds based on vitamin-A which have ordinarily been applied to treat serious cystic acne, but are acknowledged as carrying side outcomes. The bullish circumstance for Cutera is that AviClear turn

s into the new field standard as a safer and a lot more powerful choice.

If there is a scenario exactly where AviClear is as very good as the medical analyze knowledge suggest, the product ought to promote by itself, benefiting from phrase of mouth and acquiring consumers to check with for it. Also, it is encouraging to see that the present product or service portfolio from Cutera is accomplishing very well based on the newest profits traits from Q1.

The setup here is for a good lengthy-phrase investment decision in our opinion in a organization that is however in the early levels of knowing its prospective. From a superior level, these styles of aesthetic therapies protected by Cutera products and solutions gain from consumers trying to get extra cosmetics strategies with a target on wellness and elegance as a throughout the world craze.

supply: company IR

According to consensus estimates, the market place forecast is for 2022 CUTR revenue of $261 million, a bit earlier mentioned the latest administration steerage. The market then expects profits to speed up by 27% in 2023 and 33% in 2024 as AviClear gains momentum. From there, the expectation is that the company can reach profitability by 2024. We see an upside to these estimates with a extra optimistic watch of the toughness of the market option which can assistance far better-than-anticipated earnings.

Searching for Alpha

As it relates to valuation, the metric we’re concentrating on is a 1-yr ahead rate-to-gross sales numerous of 2.5x into the consensus 2023 profits forecast of $331 million. In our look at, as we get into 2023, up-to-date management direction incorporating new AviClear targets would make the stock surface especially low-cost in an environment the place product sales are climbing earlier mentioned 25% per year with a roadmap to profitability.

Using a glimpse at the inventory rate trading motion, CUTR rallied from about $45.00 for each share in mid-March to as high as $74.00 following the Fda clearance headlines as a result of mid-April. Shares have since reversed the whole transfer to currently trade under $40.00 in the context of the extraordinary market place selloff above the previous various months. Our consider Cutera simply just bought caught up in the volatility, and shares are now undervalued.

Trying to get Alpha

Final Views

We level CUTR with a selling price concentrate on of $55.00 representing a 3.5x many on the latest 2023 consensus profits. This is a stage the stock traded at as lately as mid-Could indicates a 40% upside opportunity about the subsequent calendar year. Lengthier-time period, clearer visibility on the marketplace traction of AviClear like a pattern of firming margins and earnings can mail shares greater. Up-to-date guidance from management with very long-expression financial targets could operate as a good catalyst for the inventory.

The key danger to consider would be a failure to properly execute the go-to-current market strategy for AviClear on the management’s portion. The future few quarters will be crucial in laying the foundation for advertising and income for accelerating growth starting off up coming yr. Disappointing revenue momentum or any mysterious undesirable publicity could open up the door for a leg decreased in the stock. Hard cash flow stages and the gross margin traits will be vital checking factors likely ahead.