With the crypto trading markets now in a bearish cycle, now is a great time to buy a collection of top-rated digital assets at a discount. For instance, why pay nearly $5,000 to invest in Ethereum, when the token has since hit lows of $1,000?

In this guide, we analyze the 10 best crypto to buy during the crash to benefit from declining asset prices.

List of the 10 Best Crypto to Buy During This Dip

We found that the best crypto to buy during the crash are the 10 projects listed below:

- Battle Infinity – Overall Best Crypto to Buy During This Dip

- Lucky Block – Crypto Game With Attractive Prizes and Rewards

- DeFi Coin – Decentralized Finance Hub Offering a Variety of Swap and Yield Services

- Ethereum – Leading Blockchain for Smart Contracts and Metaverse Projects

- Bitcoin – Store of Value to Hold Long-Term

- Decentraland – Best Metaverse Crypto Coin to Buy

- Stellar – Top-Quality Crypto Project That Permits Cheap and Fast Cross-Border Transactions

- XRP – Interbank Payment Solutions via Blockchain Transactions

- BNB – Native Token of the Binance Smart Chain and Exchange

- FTX Token – Crypto Asset Backing the FTX Ecosystem

Read on to find out why we like the above crypto projects.

Full Analysis of the Best Cryptos to Buy on the Dip

There are thousands of crypto tokens active in this space – most of which are now witnessing declining asset prices due to the broader bear market. As a result, there has never been a better time to build a diversified portfolio of crypto projects.

Below, we explore the 10 best crypto crash coins:

1. Battle Infinity – Overall Best Crypto to Buy During This Dip

The first new crypto project to consider from our list of the best crypto to buy during the crash is Battle Infinity. This best new crypto to buy is actually going through its presale campaign right now, which means that early investors can get the best price possible. Before we get to the specifics of its fundraising process, let’s explore why Battle Infinity is the overall best crypto to buy during this dip.

First and foremost, Battle Infinity offers a fantasy sports game that is based on blockchain in conjunction with the metaverse. This game will require users to build a sports team with their favorite players. A variety of sports are supported by the game and users will win rewards based on how their selected team of players performs in the real world.

For example, if a user has Cristiano Ronaldo selected in their football team and the player goes on to score a goal in the next game, this will be reflected in the points and subsequently rewards earned. Within the Battle Infinity ecosystem, rewards are distributed in the project’s native crypto token – IBAT.

IBAT will trade on public exchanges alongside the Battle Infinity DEX. The latter allows users to buy and cash out IBAT tokens without needing to go through a third party. The metaverse element of this fantasy sports game will ensure that users own the in-game assets that they earn. This will be represented by unique NFTs which again, can be sold on the open marketplace.

Those with an interest in this innovative project can invest in IBAT tokens via the presale by swapping BNB. The minimum presale investment is just 0.1 BNB, and this will get the user just over 166,000 IBAT.

The Battle Infinity whitepaper offers in-depth information about the project, so this is worth checking out. Information can also be sought from the Battle Infinity Telegram group.

| Min Presale Investment | 0.1 BNB |

| Max Presale Investment | 500 BNB |

| Project Chain | Binance Smart Chain |

| Presale Start Date | 11th July 2022 |

| Presale End Date | 10th October 2022 |

2. Lucky Block – Crypto Game With Attractive Prizes and Rewards

Lucky Block is also one of the best crypto to buy during the crash. Like many projects in this space, Lucky Block was experiencing a solid upward trajectory before the broader markets took a decline, meaning that this digital asset can now be purchased at a major discount. Did you know that Lucky Block had one of the best crypto presales in 2022.

Lucky Block is a crypto gaming platform that operates on top of the Binance Smart Chain. The project allows users to buy a ticket, which offers entry into the Lucky Block number-drawing game. Winning tickets will subsequently earn rewards – which are paid in the project’s native token – LBLOCK.

The Lucky Block game stands out for its commitment to transparency and decentralization. More specifically, when numbers are randomly drawn for the Lucky Block game, this is generated by smart contracts. As a result, the number-drawing process cannot be manipulated or predetermined by either Lucky Block or the players themselves.

This ensures that each and every player has access to a fair and equal chance of winning. We also like that users from all over the world can play the Lucky Block crypto game and the minimum number of tickets is just five, at $1 each. Lucky Block also has a collection of 10,000 NFTs, with holders having fee-free, lifetime access to the weekly draw.

The LBLOCK token itself is one of the biggest success stories of 2022 so far. Launched in January 2022 via a presale, the LBLOCK token was priced at just $0.00015. In just over a month of trading, Lucky Block surpassed a market capitalization of $1 billion. Therefore, it was the fastest crypto project to reach this feat.

As of writing, it is possible to buy LBLOCK at a hugely discounted price per the broader crypto winter.

3. DeFi Coin – Decentralized Finance Hub Offering a Variety of Swap and Yield Services

The next project to consider from our list of the best crypto to buy on the dip is DeFi Coin. This is the native crypto token of the DeFi Swap ecosystem, which offers decentralized finance services to users from all over the world. For example, DeFi Swap users can exchange tokens on the Binance Smart Chain without needing to register an account.

Once the wallet is connected to the DeFi Swap website, it’s just a case of selecting the two tokens to exchange and the quantity. Within a matter of seconds, the token swap will occur behind the scenes via a decentralized smart contract and be deposited straight into the user’s connected wallet.

The DeFi Swap exchange will launch its cross-chain compatibility tool within the next couple of months. This means that users will be able to swap tokens not only from the Binance Smart Chain, but many other networks. In addition to token exchanges, DeFi Swap also offers yield farming.

This means that in return for providing DeFi Swap with liquidity, the user will earn an APY on their tokens. This is funded from the trading fees that the DeFi Swap exchange collects. DeFi Swap also offers staking services, and more decentralized finance products are in the making.

Crucially, not only is DeFi Swap a new project that is still in the core stages of its development, but its underlying token – DeFi Coin, is one of the best crypto to invest in during the crash. Moreover, we like that DeFi Coin has a taxation policy in place, which takes 10% from all sell orders. This ensures that the token is bought for long-term investment purposes, rather than trading.

4. Ethereum – Leading Blockchain for Smart Contracts and Metaverse Projects

Ethereum is a large-cap cryptocurrency that all investors should consider adding to their portfolio for long-term value. It was launched in 2015 and behind Bitcoin, carries the second-largest valuation in this industry. Ethereum is best known for its smart contract capabilities, which allow developers to build decentralized apps that function autonomously.

Crucially, the Ethereum blockchain not only supports thousands of ERC-20 tokens, but plenty of metaverse projects. This includes the likes of Decentraland, which is a metaverse platform that allows users to invest in virtual real estate. As such, metaverse projects using the Ethereum blockchain are required to execute smart contracts, which subsequently require GAS.

In a nutshell, GAS refers to the transaction fee that smart contracts require when they are executed. Moreover, and perhaps most importantly, GAS is paid for in Ethereum. Therefore, this gives Ethereum a real-world use case. Another reason why Ethereum is one of the best crypto to buy during this dip is that it will soon migrate to proof-of-stake (PoS).

By migrating to PoS, this will improve the capabilities of the Ethereum blockchain significantly. Not only in terms of lower fees and faster transactions, but scalability. In fact, it is expected that PoS will take Ethereum from 16 transactions per second up to 100,000. This will make the Ethereum blockchain much more conducive for metaverse and NFT projects.

The final icing on the cake with Ethereum is that much like the broader crypto space, its token is trading at considerable lows when compared to its nearly $5,000 all-time high that it achieved in late 2021. Since the crypto winter came to fruition, Ethereum investors can now gain exposure to this token at around the $1,000 level.

Cryptoassets are highly volatile investment products. Your capital is at risk.

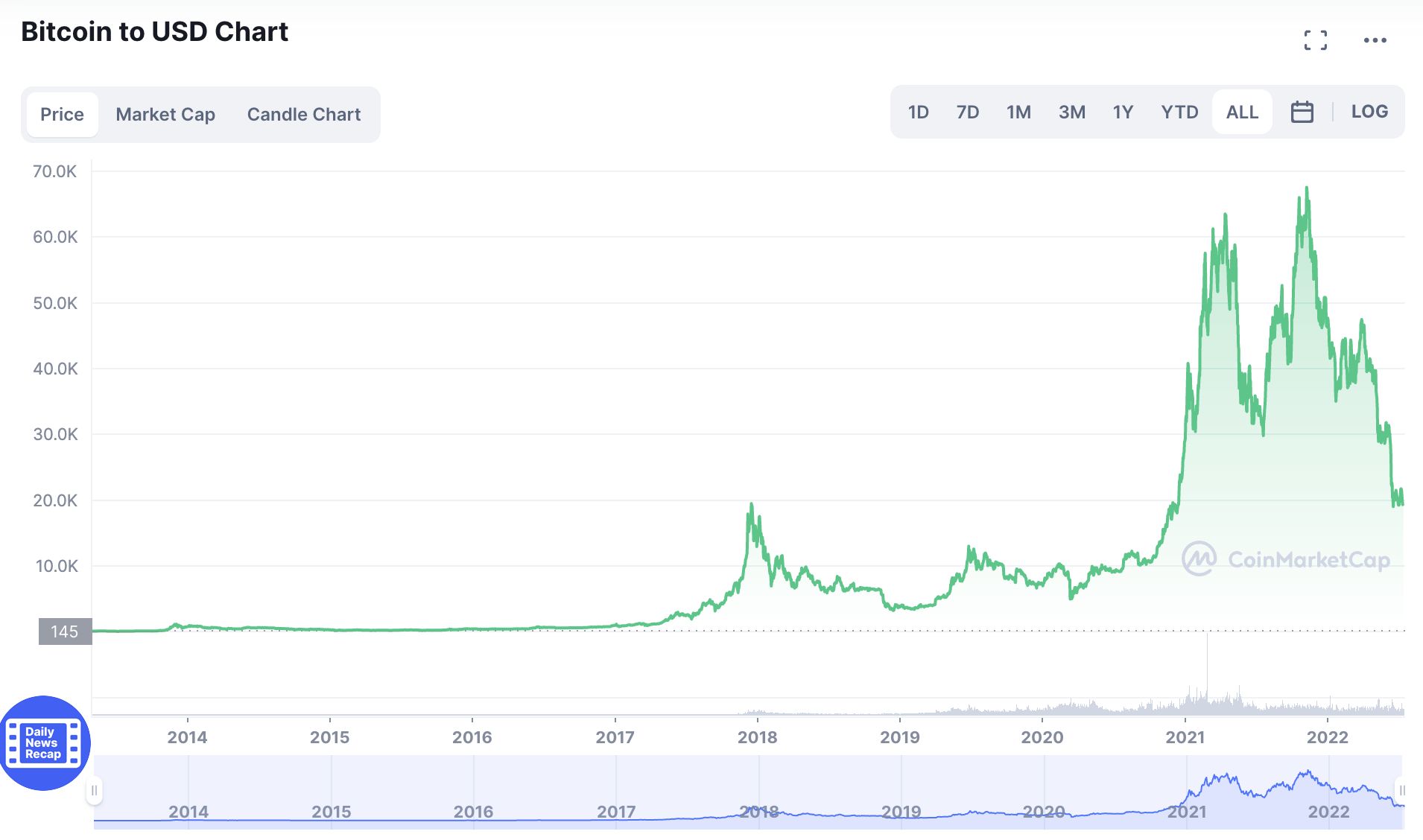

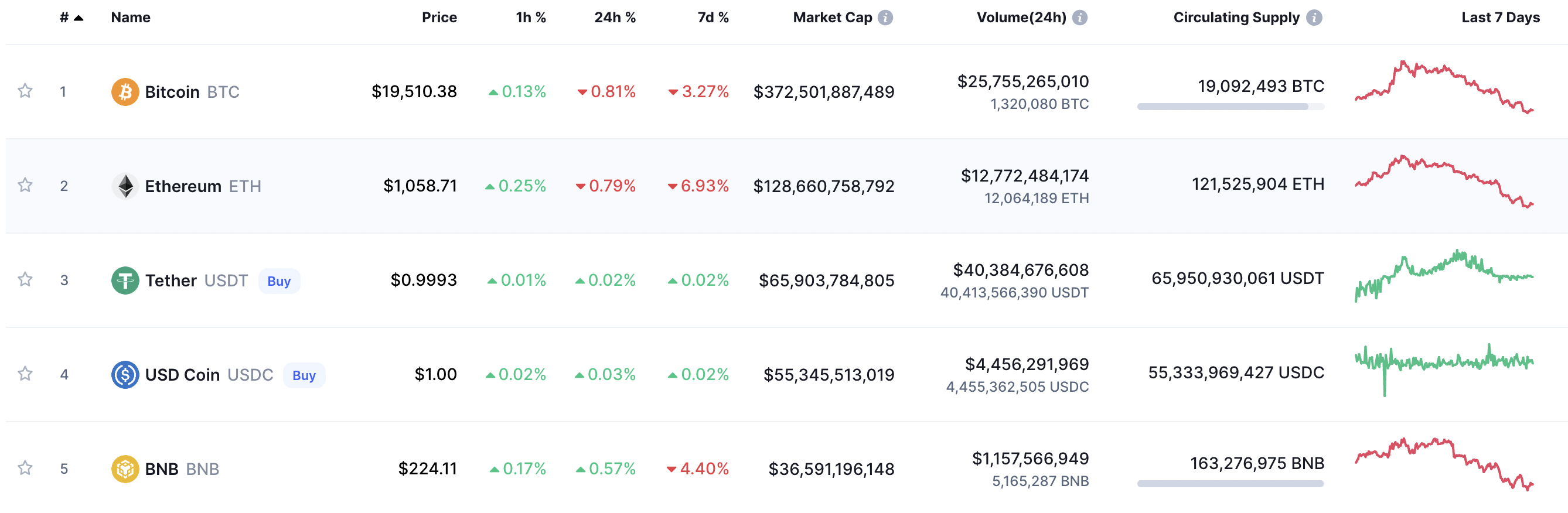

5. Bitcoin – Store of Value to Hold Long-Term

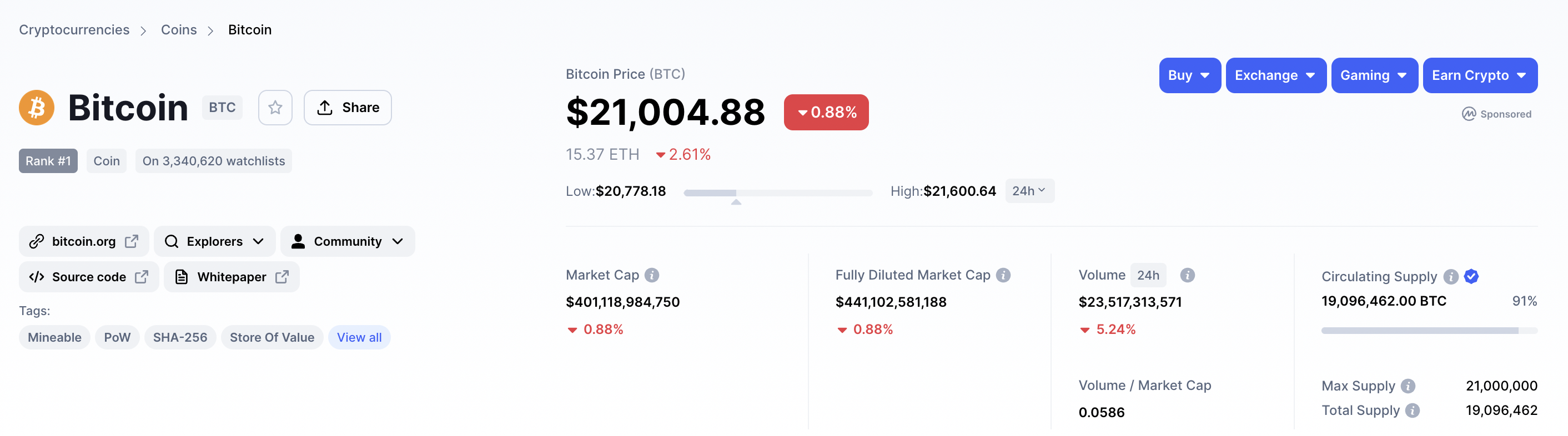

Bitcoin is the most popular crypto to buy, as it is held by the majority of investors that have exposure to this industry. It is the largest crypto by market capitalization. At its peak in late 2021 – when Bitcoin surpassed a value of over $68,000, the project hit a valuation of over $1 trillion. This made Bitcoin more valuable than most blue-chip stocks.

Nonetheless, Bitcoin has since declined in value as per the broader crypto winter. As of writing, Bitcoin seems to have entered a consolidation period of around the $20,000 level. This means that first-time investors can buy Bitcoin at a discount of over 70%, based on its prior peak.

Bitcoin is best viewed as a long-term investment due to its de-facto status as a store of value. There will only ever be 21 million Bitcoin in circulation, which is expected to happen in 2140. Moreover, Bitcoin is truly decentralized and its network cannot be controlled by any single person or authority.

Unlike a central bank, the supply of Bitcoin cannot be manipulated either, so this alleviates the risk of inflation. In fact, new Bitcoin tokens enter circulation every 10 minutes, as per its underlying code that cannot be amended. While Bitcoin still trades for many thousands of dollars, the token can be split into micro units. As such, it is possible to invest in Bitcoin with just a few dollars.

Cryptoassets are highly volatile investment products. Your capital is at risk.

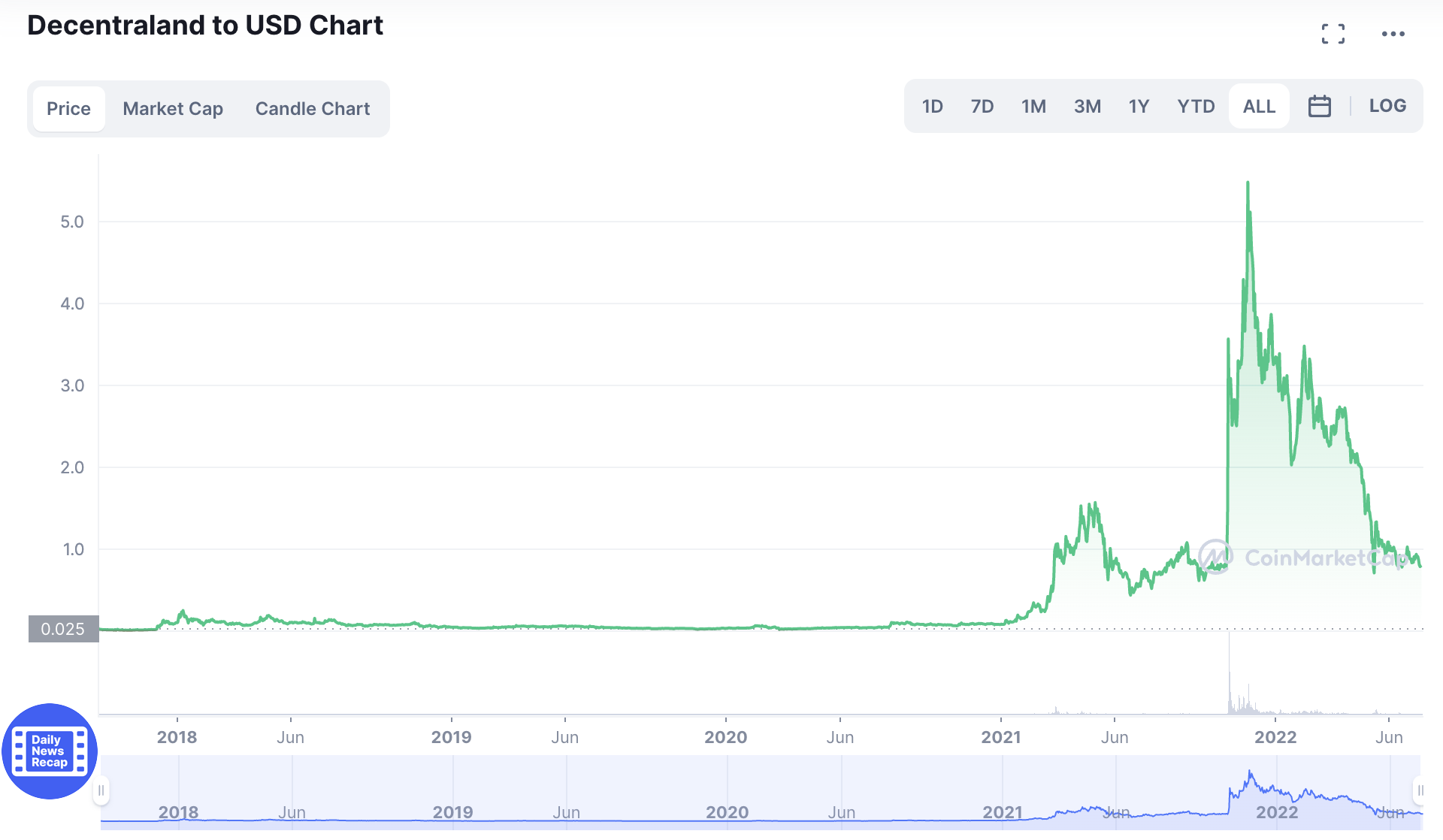

6. Decentraland – Best Metaverse Crypto Coin to Buy

We mentioned earlier that Ethereum is the leading blockchain network for the most successful metaverse projects in this space. However, Ethereum merely provides the smart contract technology for metaverse platforms. Therefore, those looking for the best metaverse crypto coin to buy during the market dip might consider an individual project like Decentraland.

This project offers a virtual world that can be accessed by users from all over the world. After connecting a wallet to Decentraland and choosing a personalized avatar, the user can then move around the virtual world and even communicate with other players.

Furthermore, and perhaps most interestingly, Decentraland allows users to buy virtual land. Only one person can purchase a specific piece of land, which is represented by an NFT to prove ownership. The land can then be used to build a virtual real estate project, such as a casino or hotel.

Each plot of land or real estate project – via an NFT, can then be sold in the open marketplace. Some transactions have attracted a sale price of several millions of dollars – all of which are conducted in the Decentraland token – MANA. This token is one of the best-performing cryptocurrencies in recent years, with gains of over 23,000% since launching in 2017.

However, due to the wider crypto winter, those with an interest in Decentraland can buy MANA tokens at a huge discount. As of writing, MANA can be bought at pricing levels that are nearly 85% lower than their late 2021 peak.

Cryptoassets are highly volatile investment products. Your capital is at risk.

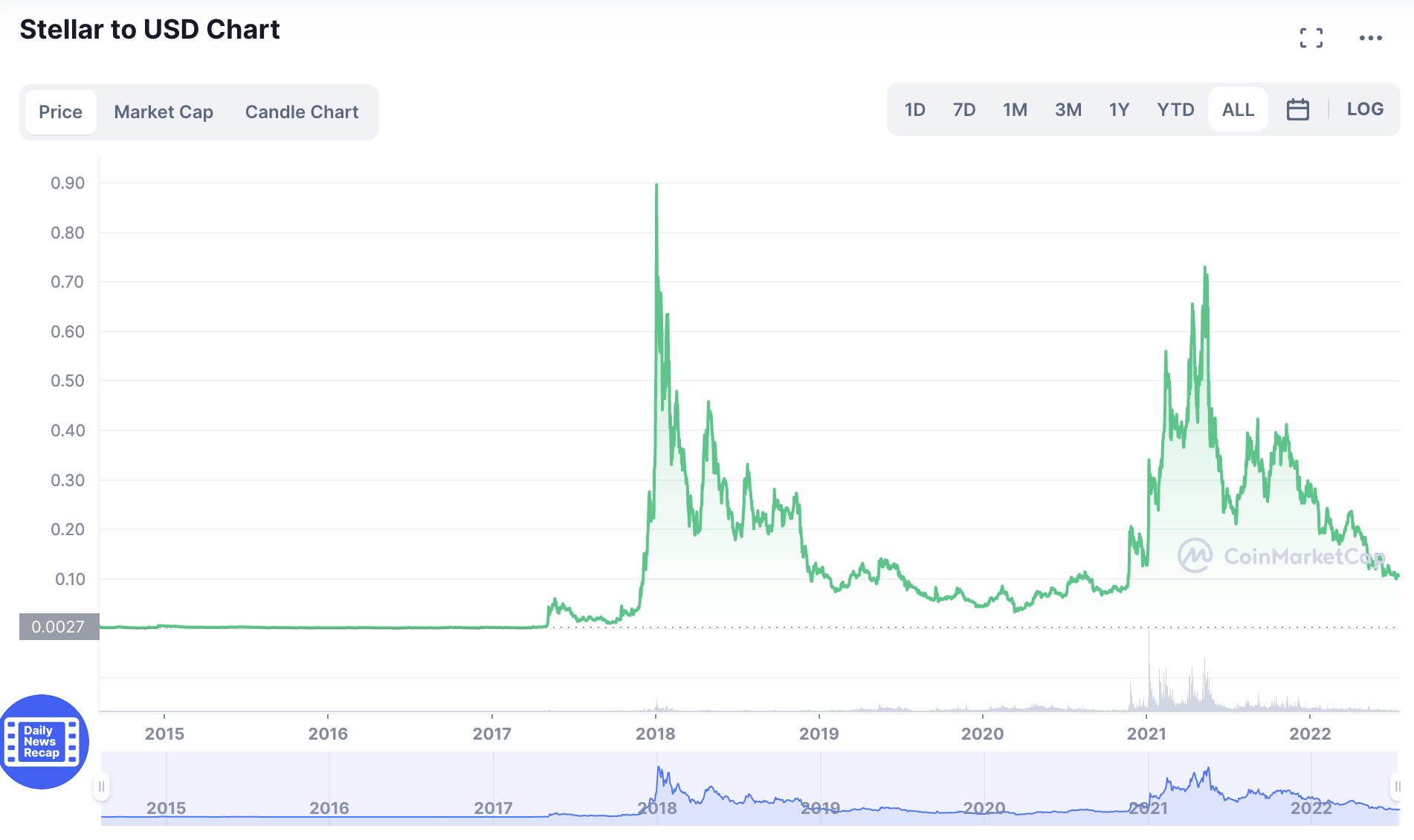

7. Stellar – Top-Quality Crypto Project That Permits Cheap and Fast Cross-Border Transactions

Stellar is a blockchain project that was first launched in 2014 by Ripple co-founder Jed McCaleb. The project allows the un-banked to transfer funds on a cross-border basis at super-low fees and fast processing times. Regarding the latter, Stellar transactions amount to a fee of just 0.00001 XLM – which, as of writing, equates to just $0.000001.

This is the case regardless of where the sender and receiver are based, or the size of the transaction. Regarding processing times, Stellar transactions typically require just five seconds before the funds are confirmed. This superior technology – which is built on its own proprietary blockchain network, has resulted in Stellar forming some highly notable partnerships.

At the forefront of this is IBM, which uses the Stellar network as part of its Universal Payment Solution program. In addition to IBM, Stellar is also used by MoneyGram. This enables the money transfer company to offer fast transactions to its customers. Stellar also has its own native crypto token – Lumens.

This digital currency trades at dozens of exchanges and subsequently can be purchased with ease. Crucially, for the purpose of this market insight on the best crypto to invest in during the crash, Lumens is now trading at a huge discount. For instance, while Stella was trading at $0.27 at the start of 2022, it has since dropped below the $0.10 level.

Cryptoassets are highly volatile investment products. Your capital is at risk.

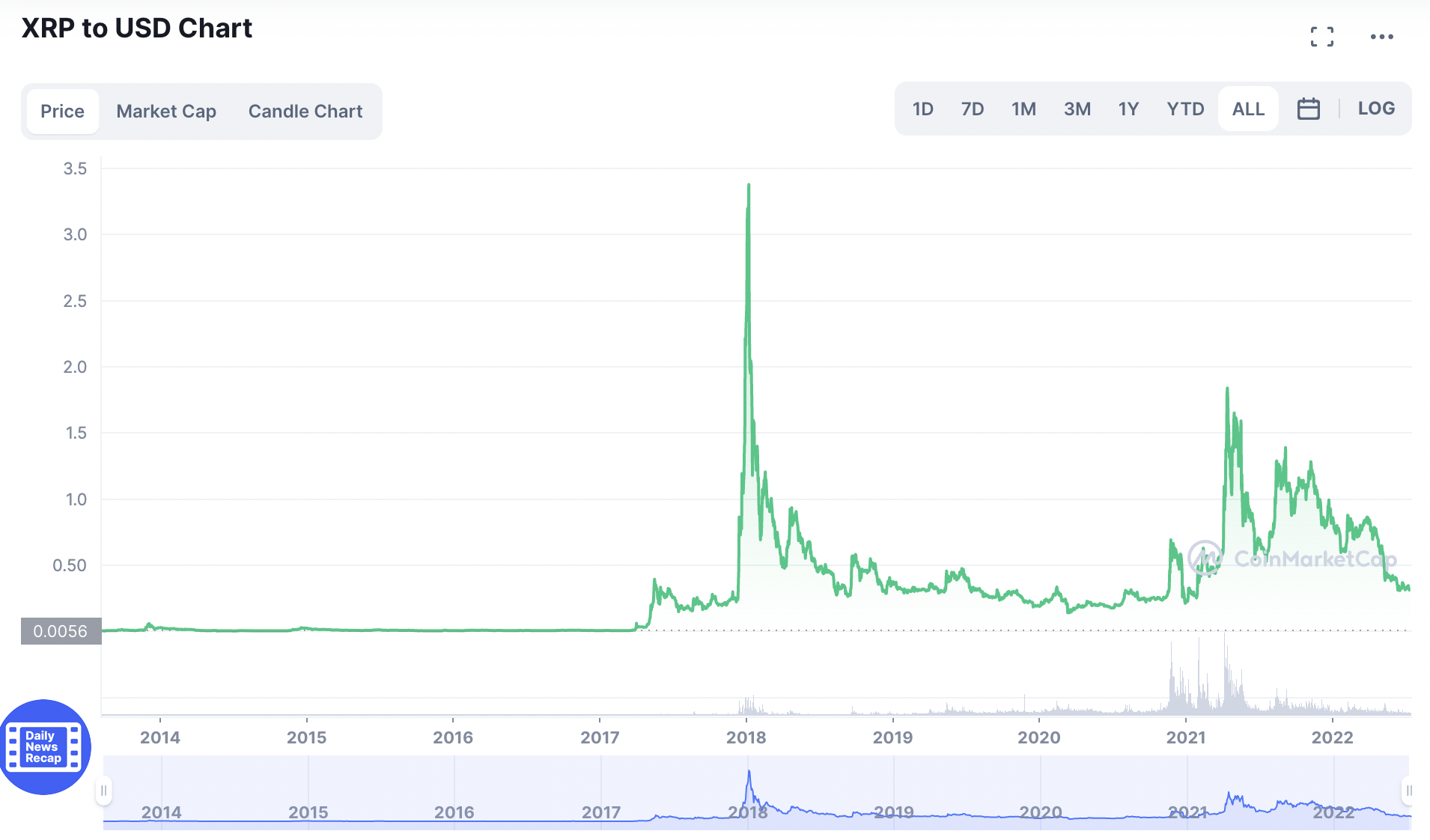

8. XRP – Interbank Payment Solutions via Blockchain Transactions

The underlying blockchain code of XRP is very similar to that of the previously discussed Stellar. For instance, both blockchains offer transaction times of around five seconds regardless of where the sender and receiver are based, and fees amount to a tiny fraction of a cent.

Moreover, both XRP and Stellar can handle approximately 1,500 transactions each and every second. However, while Stellar targets the consumer and private business sectors, XRP provides a global payments network for large banks and financial institutions.

To date, XRP is used by more than 200 partners, which includes Santander, the Bank of America, and Standard Chartered Bank. One of the most appealing aspects of the Ripple blockchain is that it permits interbank transactions in a speedy and low-cost manner irrespective of which fiat currencies are being used.

Ordinarily, institutions from the third world would be required to go through a correspondent bank in order to transact in emerging currencies. This would result in high fees, slow transaction times, and lots of regulatory red tape. However, by using XRP via the Ripple blockchain, this type of transaction can be conducted in a matter of seconds.

Cryptoassets are highly volatile investment products. Your capital is at risk.

9. BNB – Native Token of the Binance Smart Chain and Exchange

BNB is the native crypto token of the Binance ecosystem, which is inclusive of the world’s largest exchange in terms of registered users and trading volume. When BNB is used on the Binance exchange, it offers a discount of 25% on commissions. BNB can also be used to engage in staking, yield farming, and other DeFi services.

Perhaps even more notable for this token is that BNB backs the Binance Smart Chain. This blockchain network is used by thousands of projects, including the previously discussed Battle Infinity and DeFi Coin. When users wish to buy a token listed on the Binance Smart Chain, fees are paid in BNB.

Furthermore, tokens on the Binance Smart Chain are paired with BNB, so this ensures that the digital asset remains in high demand. We also like BNB for its burning program, which is initiated by Binance. This means that periodically, Binance buys an allocation of BNB and subsequently removes the tokens from circulation.

This operates in a similar way to a traditional share buyback program executed by blue-chip firms like Apple. BNB has generated some sizable returns since it was launched in 2017 and it is now one of the largest digital assets globally in terms of market capitalization. However, BNB has since dropped in value by over 70% when compared to its prior all-time high.

Cryptoassets are highly volatile investment products. Your capital is at risk.

10. FTX Token – Crypto Asset Backing the FTX Ecosystem

In many ways, FTX Token is similar to BNB, insofar that it is a digital asset that backs the proprietary FTX exchange. FTX is now one of the most popular exchanges in this space and it has a strong focus on complex crypto derivatives. This means that users can access the FTX exchange to trade tokens with leverage and short-selling capabilities.

By holding FTX Token, users of this exchange will benefit from a number of perks. This includes a trading fee discount of up to 60%. OTC buyers will be offered a discount of 0.02% on commissions. It is also possible to stake the FTX Token, which will suit investors that seek income on their digital assets.

Just like BNB, FTX Token also has a burning program in place. Among a number of other revenue streams, this is largely funded from commissions collected on the FTX exchange. The FTX Token was trading at $38 at the start of 2022 but has since hit lows of $21. This means at a 44% drop, the decline of FTX Token hasn’t been as sizable as other crypto projects.

Cryptoassets are highly volatile investment products. Your capital is at risk.

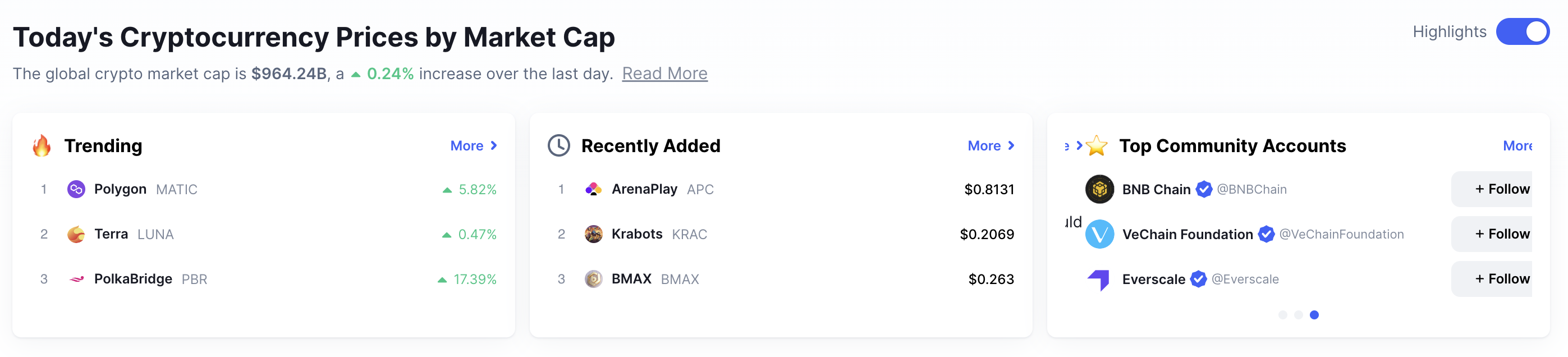

Why are Crypto Prices Crashing? Overview of the Crypto Winter

Collectively, the crypto markets witnessed a prolonged upward trajectory between April 2020 and November 2021. Bitcoin, for example, went from lows of nearly $5,000 to a new all-time high of $69,000. Other cryptocurrencies in this space – such as Shiba Inu, saw gains in the millions of percentage points.

In other words, during the aforementioned period, the crypto industry was in a bull market. This simply means that investor sentiment is strong and thus – the broader markets experience increased asset valuations. However, the vast majority of tokens in this marketplace peaked in late 2021.

Since then, crypto prices have continued to fall. As such, we are now in a crypto bear market. Crucially, however, prices are declining irrespective of the fundamentals of each individual project. Therefore, just like a stock bear market, this allows investors to buy solid crypto tokens with strong fundamentals at a major discount.

In terms of how long the current bear market will last, this remains to be seen. We can, however, look at the previous bear market, which began in December 2017 and lasted for three years. This is because it wasn’t until December 2020 that Bitcoin regained its previous all-time high of $20,000.

Is it Wise to Invest in Crypto Crash Coins During a Bear Market?

The simple answer here is yes – investing in crypto during a bear market is arguably the best time to gain exposure to this industry. After all, when the broader market is crashing, this enables investors to buy digital assets at a much lower price, when compared to previous highs.

- For example, those that invested in Bitcoin in November 2021 would have paid in the region of $68,000.

- Since then, Bitcoin has hit lows of $20,000.

- As such, those buying Bitcoin at the $20,000 level are doing so at a discount of 70% from its peak.

- Similarly, Ethereum was previously trading at nearly $5,000 in late 2021 but has since dropped below $1,000.

Buying digital assets during a crypto winter is therefore no different from investing in solid, high-grade stocks during a bear market. In fact, it is often said that seasoned investors crave bear markets, as this offers a superb way to build a diversified portfolio at highly attractive entry prices.

On the other hand, when during a bear market, many crypto tokens will never recover. As a prime example, when investors lost confidence in the Terra Luna project, its token crashed overnight – subsequently losing 99.9% of its value. The same project also saws its stablecoin – Terra USD, not only de-peg from the dollar, but become virtually worthless.

With this in mind, investors should ensure that they tread carefully when searching for the best crypto to buy during the crash. It is best to stick with solid projects with strong fundamentals, that have every chance of recovering their prior all-time highs once the broader markets once again become bullish.

Tips on How to Find the Best Crypto to Buy During the Crash

As we discussed in the section above, buying crypto tokens during a bear market can be a smart move considering the heavily discounted prices on offer.

However, not all cryptocurrencies will recover once the bear market concludes, which is why investors are required to perform their own research before proceeding.

Below, we explain what to look for when searching for the best crypto to buy during this dip.

Fundamentals

We mentioned above that picking the best crypto to buy during the crash is all about selecting projects with strong fundamentals. This simply means that investors should consider cryptocurrencies that have a solid business model alongside proprietary technology.

For example, Bitcoin is the de-facto crypto token in terms of a long-term store of value. As such, it is more of a probability than a possibility that once the broader markets recover – however long that takes, Bitcoin will eventually regain its prior highs. The same could be said for Ethereum, as well as many of the other projects we have discussed on this page.

On the other hand, it is best to stay away from so-called meme coins, which offer nothing proprietary and most definitely do not solve any real-world problems. In our view, this would include meme projects like Shiba Inu and Dogecoin.

Consider Presales for Instant Token Discounts

Although we are in a bear market, it is still wise to explore solid projects that are yet to launch on public exchanges. A prime example here is Battle Infinity, which is arguably the overall best crypto to buy during this dip.

This metaverse, NFT, and fantasy sports project – which is also building a DEX, is currently in the midst of its presale campaign. This means that early investors will get the best price possible when buying the IBAT token.

Once the 90-day presale concludes or hits its hardcap target of 16,500 BNB – whichever comes first, IBAT will then be launched to the public. When this happens, the launch price will be higher than the presale.

Therefore, this offers a great opportunity for investors to gain exposure to a growing crypto project with strong fundamentals.

Look for Sizable Discounts

Buying crypto during a bear market is all about finding discounts that may never be available again. For example, those that bought Bitcoin in the midst of the COVID-19 pandemic in April 2020 would have had access to an entry price of $5,000.

- While there are no guarantees in this space, the general consensus is that Bitcoin will likely never again drop these pricing levels.

- In the current market landscape, Bitcoin has since dropped by more than 70% when compared to its previous high of $68,000.

In the case of Decentraland, the project has declined by more than 85% from its lows, with other projects dropping by over 90%.

Build a Diversified Portfolio

Seasoned investors will look to mitigate the risk of loss by building a highly diversified portfolio of crypto tokens. This means that rather than focusing on one or two projects, it is best to gain exposure to at least 10 – perhaps more.

Each crypto token should come from a different niche, which again, will mitigate the risk of investing in a project that subsequently fails.

This is why our list of the best crypto to buy during the crash contained a full range of different projects.

Consider Where the Market Will be in Five Years

The most successful investors in the crypto space are long-term holders. By holding onto a token for at least five years, this will enable the investor to ride out inevitable bear markets, which we are currently in.

With this in mind, it is wise to consider where the crypto arena will be in five years – in terms of trends and emerging markets.

- For example, there is an expectation that in the coming years, the metaverse will reach the masses.

- And, one of the best metaverse projects we came across is Battle Infinity, which combines the virtual and real sporting worlds.

Another area that is expected to grow substantially in the coming years is decentralized finance – or DeFi. DeFi Coin – which also made our list of the best crypto to buy on the dip, is the native token of DeFi Swap.

As we noted earlier, DeFi Swap is a growing decentralized exchange that offers everything from staking and yield farming to token exchanges.

The Verdict?

Bear markets allow investors to buy crypto tokens at a major discount, when compared to their previous all-time highs. We have ranked the 10 best crypto to buy during the crash – based on the underlying fundamentals of each project.

Overall, our market research found that Battle Infinity is the best crypto to consider right now, not least because this metaverse and fantasy sports project is engaged in its 90-day presale launch.

This means that by investing in the Battle Infinity presale before it concludes, traders will have access to early-bird prices. After the presale, Battle Infinity will then launch its IBAT token via a public listing.