Damian Pawlos/iStock via Getty Images

Financial investment Thesis

Arch Sources (NYSE:ARCH) is a incredibly persuasive expense. What’s additional, the thesis right here has absolutely nothing to do with its multiple enlargement.

In truth, all my assumptions are for Arch Resources’ multiple sticking all-around 2x absolutely free cash flow.

Although I’m not a dividend trader, acquiring a 20% dividend is mightily beautiful.

Following the dividend is paid out out, buyers will nonetheless get the funds appreciation from the shares.

To reveal this, when the dividend is paid out out, the stock opens decreased when it goes ex-dividend. Soon after that, what ever is remaining on the shares, it gets ex-dividend. And regardless of what appreciation one receives is absolutely money appreciation.

Shifting on, this inventory has quite strong in the vicinity of-time period prospects. Spending close to 2x absolutely free cash stream is extremely desirable.

Use the recent price weakness to invest in some much more publicity to Arch.

Arch Resources’ In close proximity to-Term Prospects

There are a several essential dynamics that assist significant coal costs for for a longer time. The key effect was driven by Europe shunting organic fuel from Russia.

That led to a spike in organic gasoline. But by now, there’s been so quite a few ramifications that it is really complicated to say that it truly is only the Russian sanctions that are leading to substantial coal selling prices.

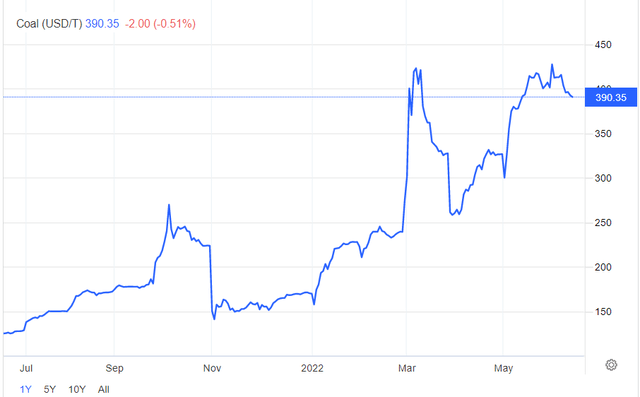

Buying and selling Economics

Of course, instantly, Europe’s in close proximity to-term desire for coal is trying to keep coal prices high. But there’s more to it than that.

In truth, preserve in thoughts that when fuel costs are previously mentioned $4 mBTU it can make much more economic perception to get the equivalent total of vitality from coal. The concrete price ranges fluctuate marginally, based on various variables.

But presented that all-natural fuel price ranges are now better than $8.5 mBTU, any electrical plant that can exchange purely natural gasoline for coal is now carrying out just this.

Arch’s Capital Allocation Plan

Not too long ago, Arch purchased back again $130 million worthy of of convertibles. Specified that Arch’s entirely diluted share rely is 21 million, we should really anticipate to see Arch’s entirely diluted share depend fall by from Q1 2022 into Q2.

This is a 1-off “buyback” as it ended up, that will add to shareholders’ returns and is obviously satisfying for shareholders.

Consequently, when Arch finishes its Q2 2022 period, Arch’s balance sheet will be in a net dollars situation. This will promptly raise its money allocation method.

But what I am even more interested in, is Arch’s dividend money allocation technique.

Presently, Arch declares that it will return to shareholders 50% of its prior quarter’s absolutely free cash movement.

Now to get some viewpoint of much cost-free income move Arch will return to shareholders in the impending quarter, think about this.

Coal was very about $250 on the spot sector in the course of Q1 2022. There are some sums that are netted off this determine to account for transportation and other charges, so it is really not the exact figure that Arch will get as coal is priced at in the location sector.

Nevertheless, suitable now, coal prices are at minimum 20% bigger than they ended up through Q1 2022. As a result, completely I now believe that that Arch could report modified free of charge dollars flows of $327 million, the moment we regulate for the better coal atmosphere, throughout Q2 2022.

Furthermore, specified that Arch is committing to returning 50% of its discretionary free of charge income move to shareholders each quarter, that usually means that Arch shareholders could see about $163 million by way of exclusive dividends.

This quantities to a 5.8% produce for just holding the inventory for in excess of 1 quarter. If we ended up to annualize this figure, that signifies shareholders would get at minimum a 20% produce more than the coming calendar year.

ARCH Valuation – Nevertheless Priced at A lot less Than 2x No cost Cash Circulation

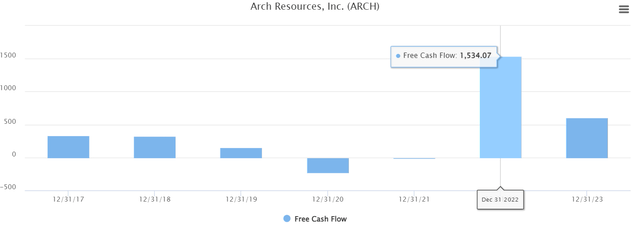

I estimate that Arch could make practically $1.4 billion of totally free dollars move. Supplied that coal charges have remained fairly stable, for now, I believe that that this estimate however tends to make feeling.

TIKR.com

Also, as you can see previously mentioned, analysts pursuing the inventory are also expecting somewhere around $1.5 billion in cost-free cash move from Arch this 12 months.

This provides me self-assurance that my estimate of $1.4 billion is in the suitable ballpark.

Premortem: Financial investment Hazards

The

possibility with investing in Arch is that coal costs instantly market off. For this to transpire, if world-wide economies were being to slow down, the need for strength could be minimized.

What’s much more, right now, the greatest driving pressure driving coal rates is that you can find limited provide hitting accessible in the current market.

But if fewer coal is made use of in the environment, what is now a tight offer environment could promptly develop into an oversupplied atmosphere that would direct to coal selling prices meaningfully sell-off.

In that case, this bullish financial investment scenario would collapse.

A further thought could be China’s lockdowns. If China remains in lockdown, the desire for coal would diminish, and that would lower coal charges and bring about Arch’s shares to provide off.

Nonetheless another thought is that to mine for coal, involves a substantial amount of diesel and large equipment. Given the substantial inflationary pressures, this will have an effect on Arch’s running functioning expenses that could effects financial gain margins.

Ultimately, to a specified extent, the bull case is remaining driven by large strength price ranges. If WTI rates cool down, that could guide to all-natural gasoline rates being reduce, which would have a knock-on affect on coal prices, specifically thermal coal.

The Bottom Line

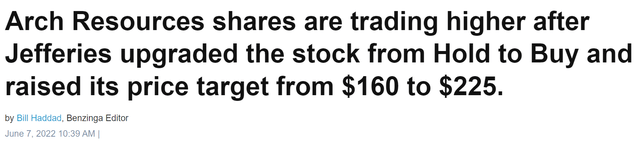

To sum it up, a number of times in the past, Jefferies upgraded Arch from a keep to a invest in, see beneath.

Selling price concentrate on amplified

That would indicate a 40% upside probable for traders. Nevertheless, retain in intellect what I have talked about over, that along the way, Arch would have approximately 20% dividends, much too.

This implies that investors’ upside from holding this inventory could actually be meaningfully greater than just 40% in excess of the coming yr.