Metals are searching to regain their luster just after a punishing pullback. Time to acquire a bullish stance on steel mining giant BHP Group applying a fusion technique with edge.

shutterstock.com – StockNews

Steel mania has turned into a steel meltdown. The purple-incredibly hot rally that took costs to extremes has now develop into a total-fledged fireplace sale. Fear of missing out (FOMO) promptly turned to anxiety of having out (FOGO). Though copper and iron costs both were also higher not too lengthy back, the punishing pullback has now taken selling prices to similar extremes of pessimism. Time for the glow to return to these two metals in excess of the coming months.

Let us seem at the two price tag charts to set matters in point of view.

Copper is back again to concentrations very last seen in November 2020. Prices bounced off big prolonged-expression aid at $3.25.

Iron price ranges are multi-12 months lows as well and far more than 50% off the modern highs of $225.

The speculative froth has without doubt been wrung out of both of those of these markets. A single could acquire copper or iron futures to posture for a rebound. That needs a truthful volume of money and additional than a fair volume of possibility hunger offered the much more speculative element of futures.

In its place, likely long BHP Group inventory (BHP) is a safer and additional successful way to acquire exposure to the two iron and copper. This is primarily legitimate provided the optimistic specialized, fundamental and POWR scores backdrop for BHP Group heading forward.

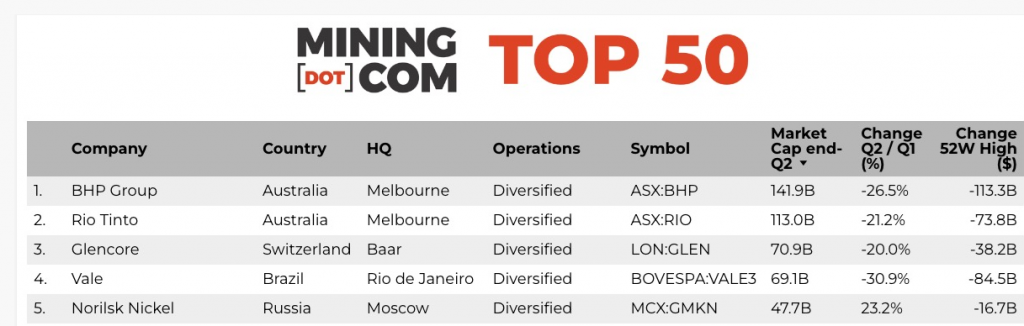

BHP is the world’s major metals corporation in accordance to Mining.com. The bulk of earnings is derived from iron and copper with some publicity to nickel and potash as properly.

The hottest earnings report exhibits that revenues for the initially half of fiscal 2022 totaled $30.5 billion, up 27% calendar year on yr. The Iron ore segment’s revenues rose 12% 12 months more than year to $16 billion. Revenues in the Copper phase improved 20% to $8 billion. Iron and copper mixed for roughly 66% of the in general profits in Q1 2022 for BHP. So unquestionably, BHP is correlated to fluctuations in iron and copper each.

In fact, the final time iron prices strike this minimal a stage (Q4 of 2021) marked a main base in BHP inventory.

Technicals

This correlation to copper and iron can be observed in the value chart for BHP stock under. It has adopted alongside with equally the increase and subsequent drop in copper and iron price ranges so significantly in 2022.

BHP inventory reached oversold readings on a specialized basis before strengthening. 9-day RSI bounced from the 20 place. MACD has turned from deeply destructive to positive and just created a get signal. Bollinger % B printed down below the zero line but has due to the fact moved back again perfectly previously mentioned it. BHP was buying and selling at a huge lower price to the 20-working day relocating typical. Shares the moment again held the critical $47 assist area.

Previous moments all these indicators aligned in a similar vogue marked sizeable quick-expression lows in BHP stock. Each and every of these observed BHP in the long run crack back effectively earlier mentioned the 20-day moving normal before the rally finally stalled.

If background follows accommodate the moment again, this hottest rally may well have far more area to run. In addition, BHP was bigger Friday. This was on a day when most shares, and steel stocks, ended up sharply reduced. The sellers may perhaps lastly be having fatigued.

Fundamentals

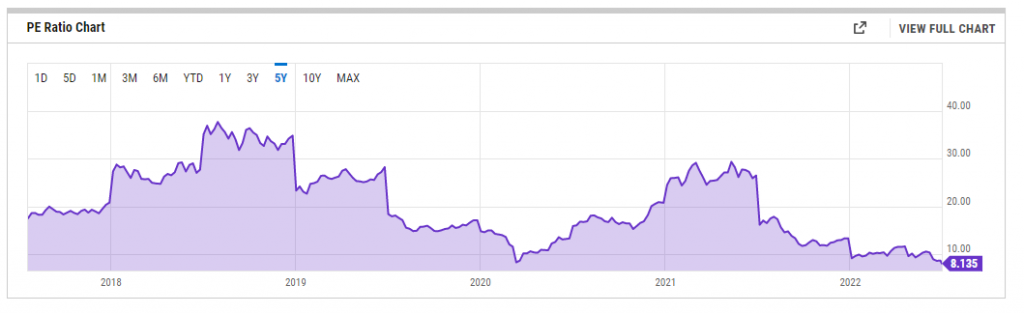

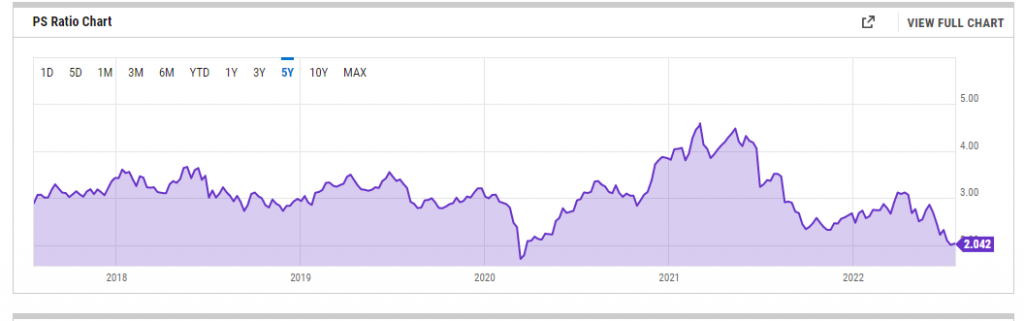

BHP inventory is investing near trough valuations on the two a P/E and P/S foundation.

Present-day P/E now stands at just above 8 and the most affordable various since the Covid Disaster lows of March 2020.

P/S is also approaching historically inexpensive valuations as it nears 2x.

The past time both equally P/E and P/S ended up this affordable was the commencing of a key rally in BHP inventory (see cost chart earlier mentioned). Furthermore, a dividend produce now over 11% with a payout ratio of just beneath 80% ought to present a solid floor for the stock around the foreseeable long term, even offered the chance on a dividend cut down the highway.

POWR Rating

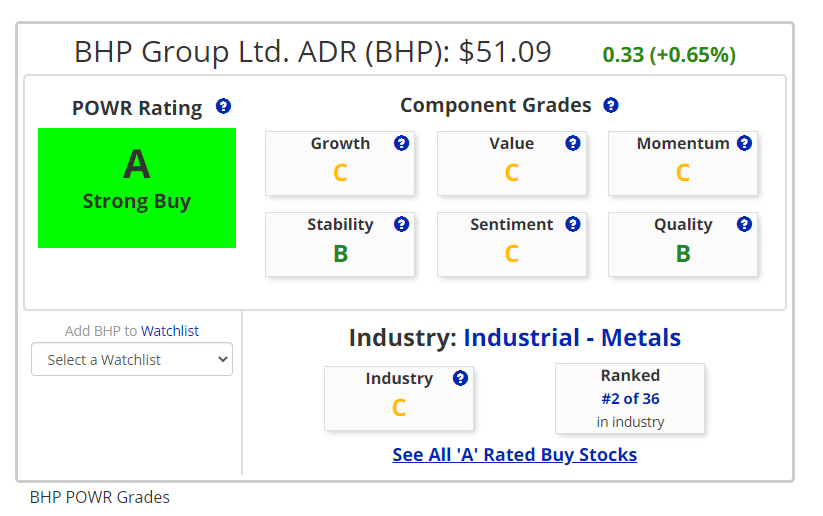

BHP is an A Rated–Strong Purchase-stock from a POWR standpoint. It is also rated variety two out of 36 inside of the industrial metals sector. Sound grades across the board as very well. Opportune time to just take advantage of a Powerful Purchase inventory at an appealing cost.

Volatility is in this article to stay, at minimum for a when. Embracing volatility, instead of fearing it, is crucial to lengthy-expression investing and trading achievements. The recent cost motion in iron, copper, and BHP stock undoubtedly serves to validate the Warren Buffett principle to be “fearful when many others are greedy, and greedy when many others are fearful”. Now is the time to get a minimal greedy in BHP stock.

We a short while ago took a bullish placement in BHP inventory in the POWR Options Portfolio making use of this fusion strategy. It brings together both equally technical and essential assessment along with the ability of the POWR Ratings technique to discover the edge and place probabilities in your favor. At the conclusion of the working day, investing and investing is all about probabilities and not certainty.

POWR Solutions

What To Do Future?

If you might be on the lookout for the best selections trades for modern current market, you must examine out our most up-to-date presentation How to Trade Possibilities with the POWR Rankings. Listed here we show you how to regularly come across the top rated solutions trades, though minimizing hazard.

If that appeals to you, and you want to learn much more about this impressive new selections system, then click on beneath to get access to this timely expenditure presentation now:

How to Trade Choices with the POWR Rankings

All the Very best!

Tim Biggam

Editor, POWR Possibilities E-newsletter

shares shut at $395.09 on Friday, down $-3.70 (-.93%). Calendar year-to-day, has declined -16.20%, versus a % increase in the benchmark S&P 500 index through the similar interval.

About the Writer: Tim Biggam

Tim invested 13 yrs as Chief Selections Strategist at Male Securities in Chicago, 4 years as Lead Options Strategist at ThinkorSwim and 3 yrs as a Current market Maker for To start with Selections in Chicago. He makes frequent appearances on Bloomberg Television set and is a weekly contributor to the TD Ameritrade Network “Morning Trade Reside”. His overriding enthusiasm is to make the complicated entire world of alternatives additional understandable and therefore much more beneficial to the day to day trader. Tim is the editor of the POWR Alternatives e-newsletter. Find out much more about Tim’s background, alongside with hyperlinks to his most modern articles.

The post 3 Causes Why BHP Inventory Is The Most effective Way To Engage in For A Rebound Rally in Metals appeared initial on StockNews.com